Oral Oncolytics / Addressing the Barriers to Access and Identifying Areas for Engagement

The Community Oncology Alliance (COA), working with Avalere Health, undertook a research effort to assess the current oncology landscape and identify barriers to the uptake of oral oncology agents. The overall objective of this engagement was to examine access challenges related to oral oncolytics and assess ways to potentially mitigate these challenges to ensure that physicians can prescribe the most clinically appropriate oncolytic for a patient, regardless of drug formulation, which is in the best interest of all stakeholders.

To achieve the goals and objectives of this research effort, Avalere conducted a broad range of activities, including a literature review, an analysis of public and private payer policies and claims activity, and stakeholder interviews. We then translated the key findings from the research into a set of materials describing current best practices that oncology offices and payers use to afford patients access to oral oncolytics. The culmination of the research is a set of options that stakeholders should consider when addressing the access barriers facing oral oncolytics. As a supplement to initial findings of this endeavor, we initiated a quantitative analysis to obtain further insight into patient behaviors as it relates to oral oncolytics.

Avalere identified numerous access challenges, for example, the bifurcated insurance benefit design and its’ affect on disparate patient cost-sharing. Additionally, providers are faced with declining reimbursement for drugs but face increasingly complex patients and treatment decisions. As a result, Avalere identified four existing best practices that oncology offices and payers can implement to ensure patient access to oral oncolytics:

- In-Office Pharmacy

- Health Plan Consultation with Practicing Oncologist

- Dedicated Financial Counselor

- Health Information Technology and Electronic Medical Record Usage

Avalere also identified several potential areas of engagement and utilized several evaluation criteria to select seven areas of engagement for stakeholders to consider when addressing access barriers to oral oncolytics. The seven areas of engagement are:

- Create one universal enrollment form for all patient assistance programs

- Engage with private payers to improve access to oral oncolytics, streamline administrative processes, and equalize coverage between formulations

- Move all oral oncolytics under the medical benefit

- Establish provider reimbursement for oncology treatment planning

- Create an oncology-specific benefit

- Expand access to oncology in-office pharmacies and ensure that private payers contract with such pharmacies

- Develop payer messages regarding the potential issues surrounding the use of episode-of-care (EOC) payment models in oncology.

In summary, oral oncolytics offer patients ease of administration and the convenience of treatment at home. A significant proportion of cancer patients currently benefit from this valuable therapy, but significant access issues remain. With 25 percent of the oncology drug pipeline in oral form, use of oral oncolytics will only grow. Unfortunately, the healthcare system is ill-equipped to handle the growing oral oncolytics market. The challenges discussed in this report paint a vivid portrait of access challenges that the current system poses for oral oncolytics. It also points to opportunities for reform to ensure patients receive the most clinically appropriate oncolytic. Our report suggests best practices that can be immediately implemented to help mitigate these difficulties, and when paired with longer-term areas of consideration for the oncology community, may ultimately help ensure patients can consistently access the most clinically appropriate therapies to treat their disease.

Project Overview

The Community Oncology Alliance (COA), working with Avalere Health, undertook a research effort to assess the current oncology landscape and identify barriers to the uptake of oral oncology agents. The overall objective of this engagement was to examine access challenges for oral oncolytics and assess ways to potentially mitigate these challenges to ensure that physicians can prescribe the most clinically appropriate oncolytic for a patient, regardless of drug formulation, which is in the best interest of all stakeholders.

To achieve the goals and objectives of this research effort, Avalere conducted a broad range of activities, including a literature review, an analysis of public and private payer policies and claims activity, and stakeholder interviews. We then translated the key findings from the research into a set of materials describing current best practices that oncology offices and payers use to afford patients access to oral oncolytics. The culmination of the research is a set of options that stakeholders should consider when addressing the access barriers facing oral oncolytics. As a supplement to initial findings of this endeavor, we initiated a quantitative analysis to obtain further insight into patient behaviors as it relates to oral oncolytics. We outline the results and key findings of the research in the remainder of this paper’s five sections as described below.

Section 1 presents the issues relevant to the use of oral oncolytics in cancer treatment and describes the challenges that each oncology stakeholder faces regarding access to oral oncolytics. In addition, it summarizes our findings from a review of the published literature and analysis of current activities within the oncology community relating to access to oncology treatments. To evaluate the current landscape for oral oncolytics and identify barriers to access, Avalere examined coverage policies and formularies for selected commercial health plans, Parts A and B Medicare Administrative Contractors (MACs), and Medicare Part D plans. We also reviewed reports, proposals, and activity from relevant groups such as the Centers for Medicare & Medicaid Services (CMS) and the Medicare Payment Advisory Commission (MedPAC).

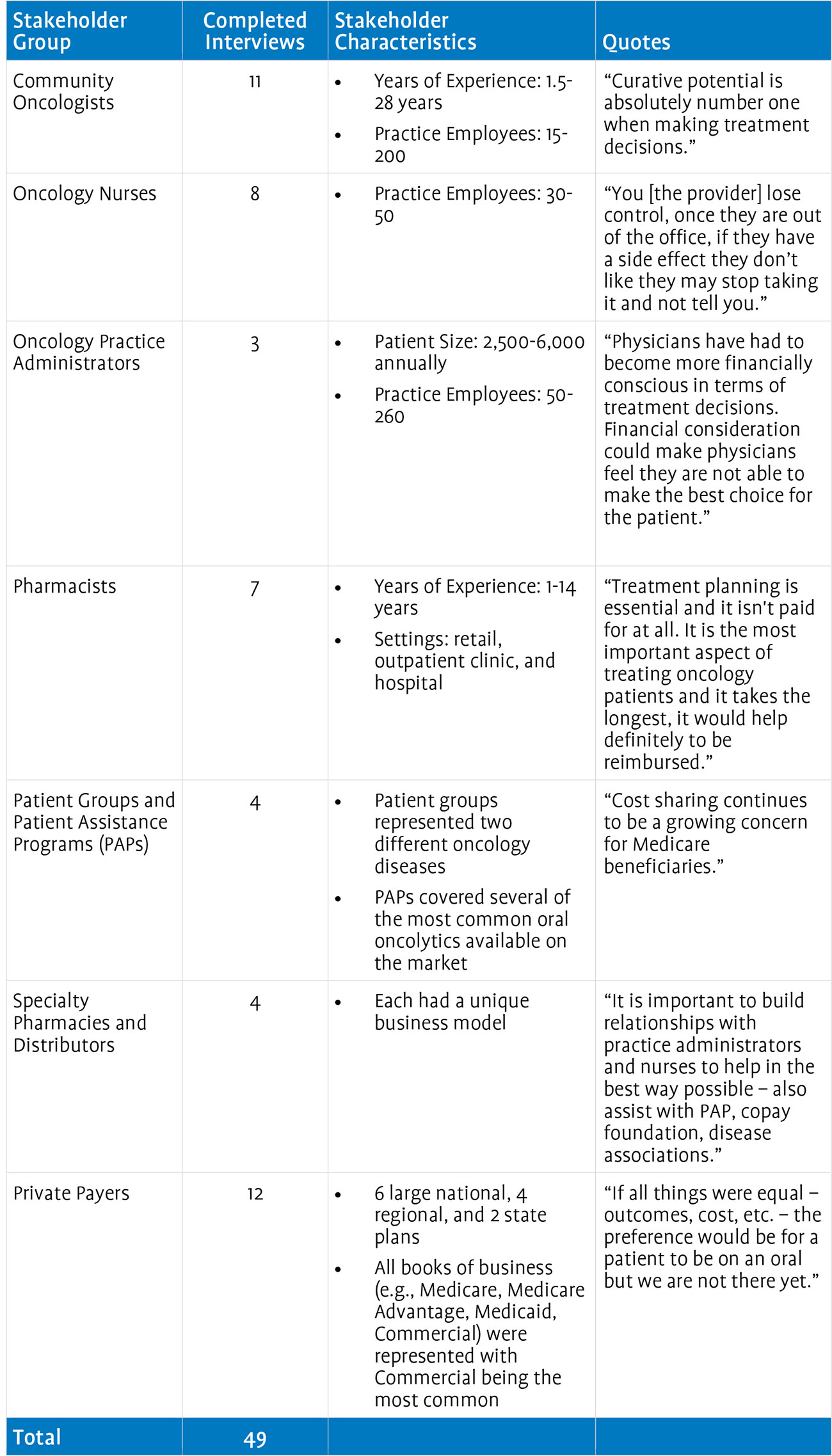

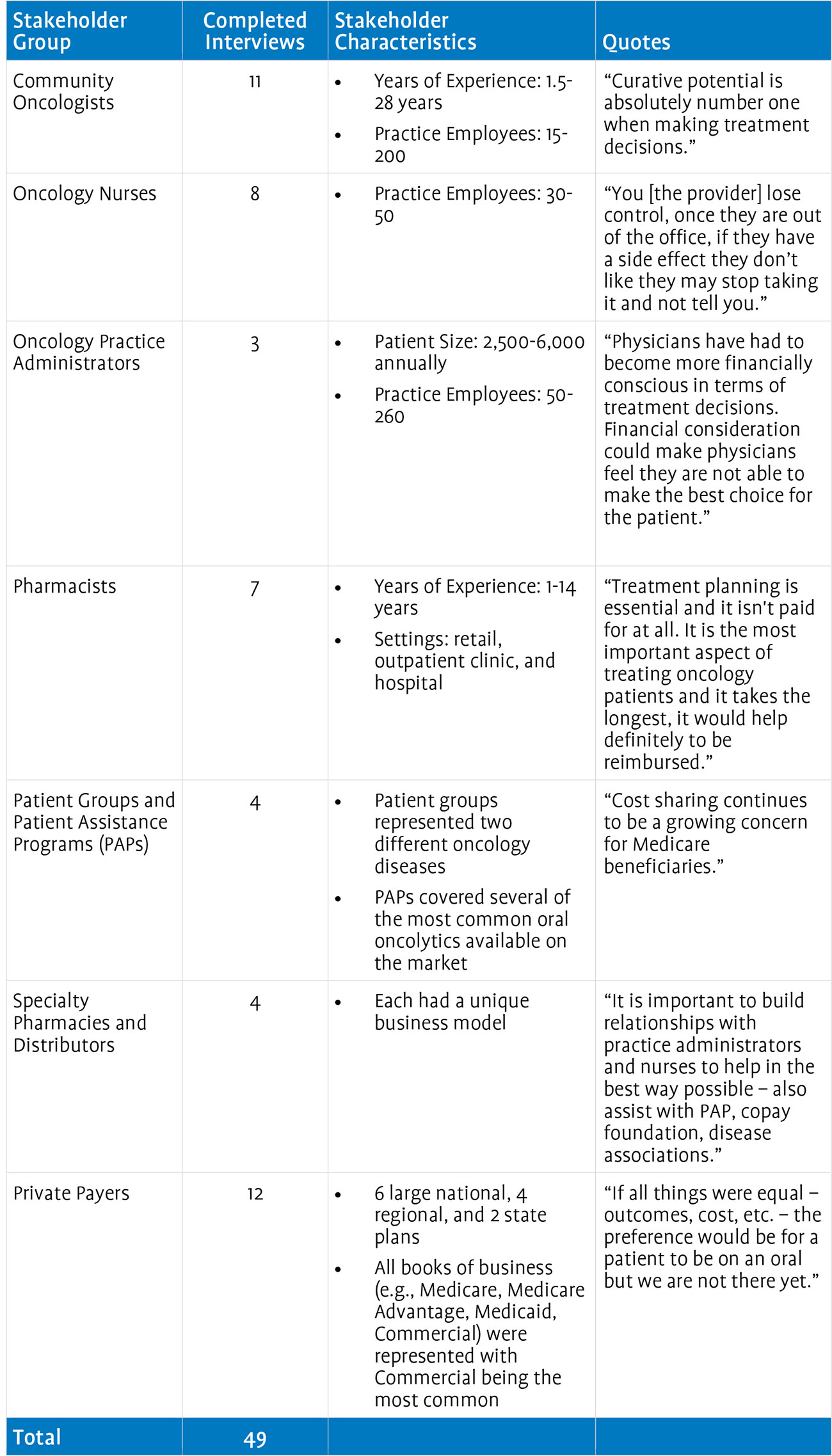

Section 2 comprises: (1) an issues map that delineates the current issues affecting access to oral oncolytics and (2) a set of best practices, which describe effective strategies for enhancing access to oral oncolytics within the current system, absent broader system reform. Both of these documents reflect substantive input from interviews with a large and diverse group of stakeholders. In total, Avalere interviewed 54 entities intimately familiar with the provision of oncology care. This group included 11 community oncologists, 8 oncology nurses, 3 oncology practice administrators, 7 pharmacists, 4 patient groups and patient assistance programs (PAPs), 4 specialty pharmacies and distributors, 5 manufacturers, and 12 private payers.

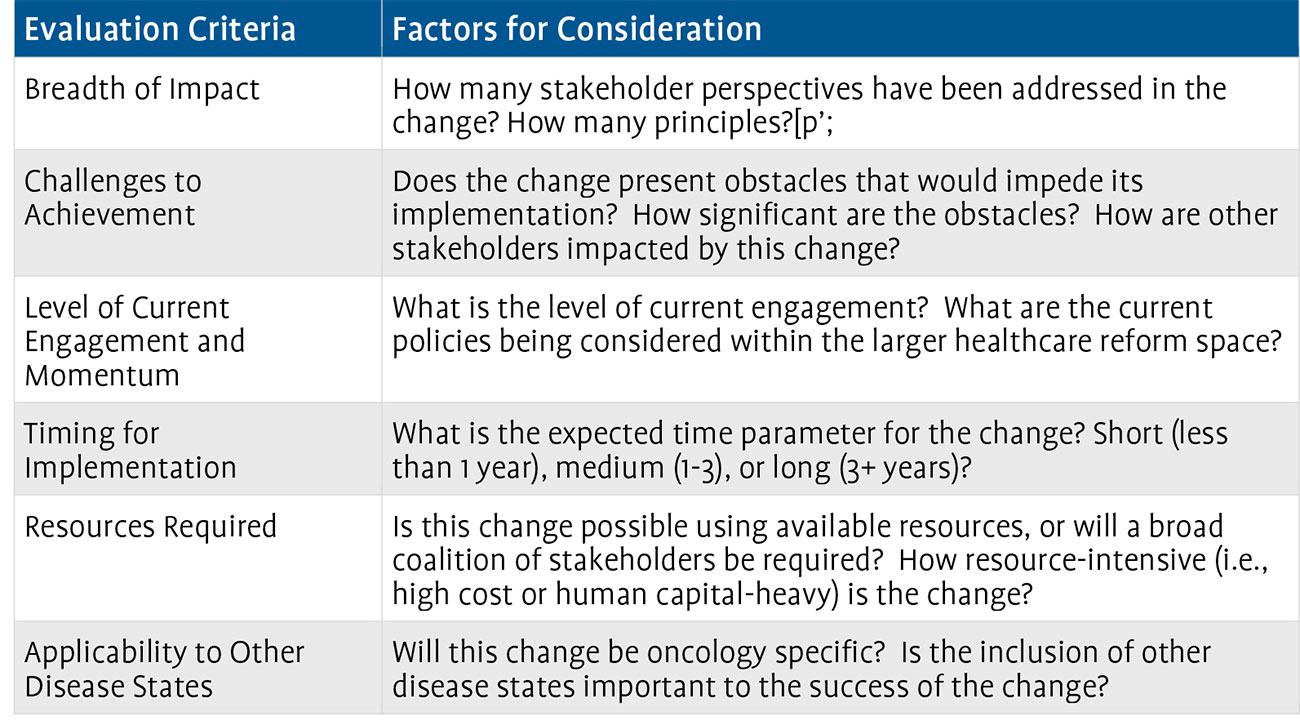

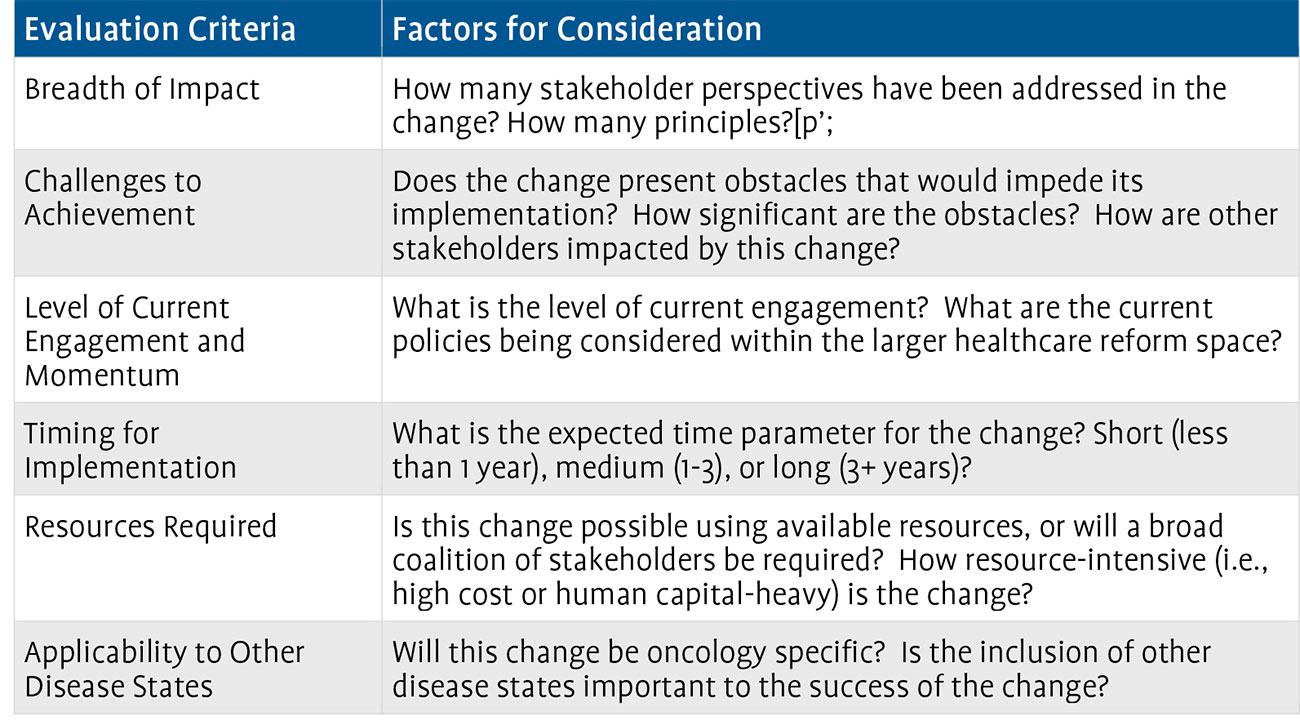

Section 3 outlines seven options that the oncology community should consider pursuing to remove existing access barriers to oral oncolytics. Avalere collated input from the stakeholder interviews, COA’s Oral Oncolytics Working Group, and internal expertise to develop a comprehensive set of potential focus areas that if pursued, could improve patient access. This initial assessment yielded 27 potential areas for engagement. Avalere then critically evaluated each potential engagement area across a variety of criteria to identify a subset of actionable strategic initiatives for the oncology community to consider pursuing in its collective effort to ensure optimal care for cancer patients. We evaluated the initiatives against certain criteria including (1) breadth of impact (i.e., how effective the initiative would be in mitigating access concerns for oral oncolytics), (2) challenges to implementation (i.e., how difficult would it be to gain stakeholder consensus and the action necessary for enactment), and (3) resources required to implement the initiative (i.e., what other resources would be needed to implement a set of steps, either monetary resources or alignment with other, diverse stakeholder groups). The full list of criteria will be described later. Avalere quantified each of the individual criteria to cull the list of 27 to a list of the 7 recommended areas of engagement.

Section 4 provides a summary of the preliminary findings of the follow-on quantitative project. Avalere conducted an analysis of data provided by Wolters Kluwer to obtain a more robust understanding of patient behavior at the point of sale for oral oncolytics. Specifically, Avalere explored the rates of reversal for oral oncology agents, the reasons for rejection at the payer level, and the level of cost sharing that patients face for oral oncolytics.

Finally, our conclusion offers recommended next steps for the oncology community to consider undertaking to mitigate access barriers for oral oncolytics. In addition, the conclusion offers an overview of current developments in health reform that could directly impact the oncology community and, more specifically, access to oral oncolytics.

Section 1: Why Oral Oncolytics Matter and Current Challenges Associated with Access

Why Is There Concern About Access to Oral Therapies?

Oral oncolytics can offer patients greater flexibility than IV oncolytics but also present unique challenges to physicians, patients, pharmacists, health insurers, and other stakeholders. In particular, the availability of oral and IV drugs within the same therapeutic class and the existence of oral and IV formulations of certain drugs complicates physician decision-making.

In addition to purely clinical considerations, there are non-clinical factors that can affect therapy selection. An oral oncolytic may be most clinically appropriate for a patient, but compliance concerns with oral drugs may lead the physician to prescribe an IV oncolytic instead because of the greater control over delivery afforded by IV drugs administered in a medical office.

While compliance is a concern for all oral drugs, it is particularly relevant for oral oncolytics because of some of the side effects associated with these products. Because oral oncolytics are taken outside of the office setting, providers are unable to closely monitor the side effects. Additionally, without the daily or weekly interaction that occurs between patient and provider when receiving IV infusions, patients may independently alter the dose of an oral oncolytic to reduce side effects, never apprising the provider of the change to their dosing schedule. Furthermore, cost sharing can contribute to compliance concerns with oral oncolytics because many of these drugs are often subject to higher patient cost sharing than related IV oncolytics.

Physicians and pharmacists also face administrative battles when prescribing and dispensing oral oncolytics. A health plan’s greater ability to manage oral drugs as compared to IV drugs translates into increased paperwork for the physicians that prescribe and pharmacists that dispense oral drugs.

Finally, many stakeholders believe that because providers are reimbursed directly when using IVs, they may have a financial incentive to use the IV product instead of an oral. However, providers disagree, saying there is little to no financial incentive for IVs because providers are not fully compensated for the components of care required to deliver IV oncolytics, nor does the reimbursement for the drug always equal the cost of the product.

These challenges might seem inconsequential if they affected only a few patients or products, but with oral oncolytics representing an increasing portion of oncolytic prescriptions and approximately 25 percent of the oncology drug pipeline, they are challenges very much of the present.1

Challenges Facing Oral Oncolytics

The existing infrastructure of insurance benefit design contributes significantly to the access issues patients encounter when attempting to obtain oral oncology agents. Medicare and most other insurers have separate medical and pharmacy benefits. The medical benefit generally covers hospital visits and physician services, including physician-administered drugs. The pharmacy benefit generally covers drugs that a patient self-administers, such as pills and some subcutaneous injectables. This bifurcated insurance landscape can create artificial incentives and disincentives to use certain products. Further, variance in patient cost sharing can challenge patients financially, and some patients may have only medical benefit coverage, cutting them off from therapies covered in the prescription drug benefit. Medicare, with Parts A, B, and D, offers a striking example of the complexity of today’s insurance market and showcases the difficulties that patients experience interacting with these entities.

Part B: Physician-Administered Drug Coverage

The establishment of Medicare Part B took place at the inception of the Medicare program in 1965. The Social Security Act defines drugs covered under Medicare Part B as those furnished “incident to” a physician service that are not usually self-administered by the patient.2 The Centers for Medicare & Medicaid Services (CMS) currently defines IV and intramuscular (IM) injections as not usually self-administered. Conversely, oral drugs are considered usually self-administered and as such, Medicare Part B does not cover them, with rare exceptions.

Though Part B generally only covers drugs administered “incident to” a physician service and not self-administered drugs, Congress extended Medicare Part B coverage to certain oral anticancer drugs in the Omnibus Budget Reconciliation Act of 1993 (P.L. 103-66).3 The basis for this coverage expansion was the fact that Part B covered the IV formulations of these drugs and Congress wanted to ensure that Medicare beneficiaries could access the oral formulations as they came to market. Medicare Part D (i.e., the pharmacy benefit) had not yet come about and Congress’s extension of coverage to this limited number of oral oncolytics acted as a patch to the system.

CMS later expanded Medicare Part B coverage to prodrugs, which are pharmacologically inactive substances that are the modified forms of pharmacologically active drugs to which they are converted (as by enzymatic action) in the body. This expansion resulted in coverage for eight oral oncolytics: ALKERAN® (melphalan), HYCAMTIN® (topotecan hydrochloride), MYLERAN® (busulfan), TEMODAR® (temozolomide), XELODA® (capecitabine), cyclophosphamide, etoposide, and methotrexate.

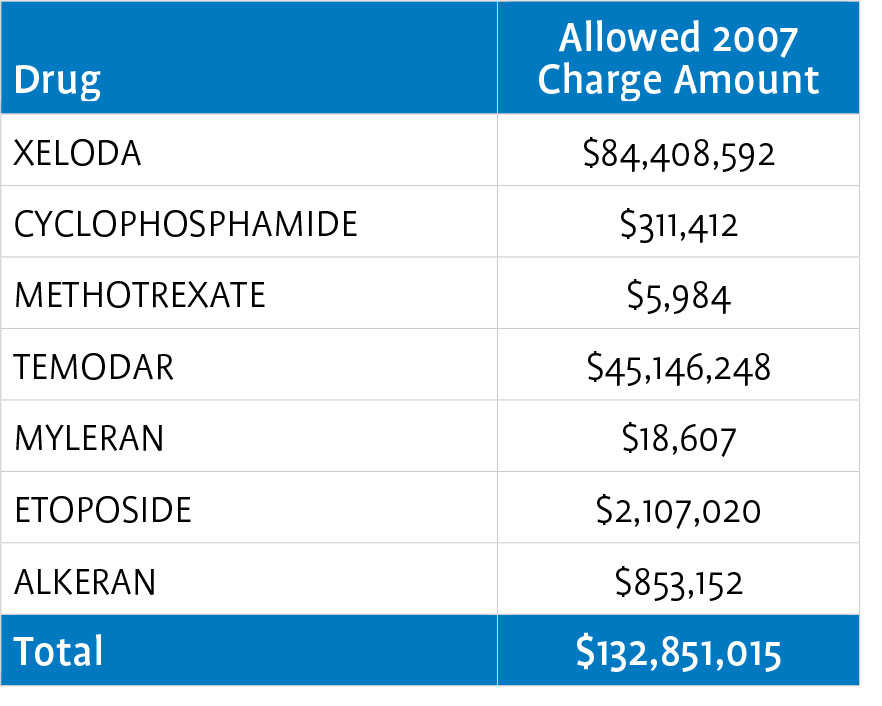

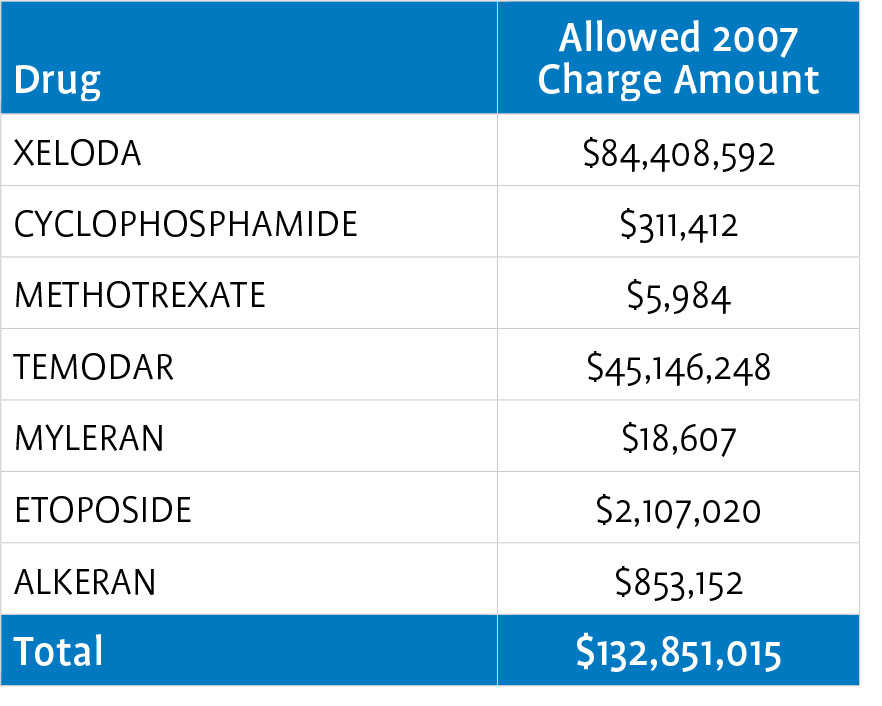

The table below outlines 2007 Medicare Part B expenditures for the covered oral- anticancer drugs.4

Generally, Medicare patients must pay a 20-percent coinsurance for drugs and their associated administration procedures under Part B. While there is no catastrophic threshold or out-of-pocket maximum for beneficiaries under the Part B benefit, 89 percent of beneficiaries have supplemental coverage that reduces or eliminates the 20- percent cost sharing.5 Depending on their level of insurance coverage, some patients also may be eligible for assistance from copay foundations or manufacturer patient assistance programs.

Medicare Part B covers only eight oral oncolytics. Medicare Part D, which covers all other oral oncolytics, has a significantly different benefit structure than Part B.

Part D Overview: Benefit Design and Cost Sharing

The Medicare Prescription Drug, Improvement, and Modernization Act (MMA) of 2003 (P.L. 108-173) created Medicare’s outpatient prescription drug benefit, known as Part D. The Medicare Part D benefit began in January 2006 and covers most oral drugs not covered under Part B. As outlined below, the structure of Part D is decidedly different from that of Part B.

The MMA authorized CMS to contract with private health plans to administer the drug benefit. Two plan types are available: standalone prescription drug plans (PDPs), which only offer a drug benefit, and Medicare Advantage prescription drug (MA-PD) plans that offer both medical and pharmacy coverage. Of the 26.7 million Medicare beneficiaries enrolled in Part D in 2009, approximately two-thirds are enrolled in PDPs.6

The MMA specified a standard benefit design for Part D plans to follow. The standard benefit includes 25-percent cost sharing for prescriptions, a deductible determined annually by CMS, and a monthly premium determined annually by the plan. Unique to the Medicare Part D market is the coverage gap, commonly known as the “donut hole.” In the coverage gap, beneficiaries must pay 100 percent of the cost of their prescriptions until they reach the catastrophic phase of the benefit, at which point they pay only 5 percent of their drug’s cost.

The majority of Part D plans, however, offer an alternative to the standard benefit design: 90 percent of PDPs and 95 percent of MA-PDs in 2009. Under alternative benefit designs, plans may create formulary tiers, reduce the deductible, or offer enhanced coverage such as coverage in the coverage gap. Plans also have wider latitude over the cost-sharing amounts that patients are responsible for when using this type of benefit structure. All Part D plans, regardless of their benefit design, must cover “all or substantially all” products that fall within six classes that CMS has deemed “protected.” One of the protected classes is antineoplastics. Designation as a protected class may increase coverage of drugs within that class; however, it is particularly noteworthy that the “protected” designation does not dictate tier placement. Thus, Part D plans may still place products in a protected class on a high cost-sharing tier.

Although there are specific policies determining which drugs are covered under Medicare Part B versus Part D, it is not always evident to prescribers, patients, or other stakeholders which product is covered under which benefit, resulting in Medicare Part B versus Part D coverage confusion.

Determining Part B vs. Part D Coverage

Congress knew that confusion would exist in terms of clearly delineating Medicare Part B versus Part D coverage for certain drugs, particularly oral oncolytics. Therefore, the MMA tasked the Secretary of the Department of Health and Human Services (HHS) with developing recommendations, prior to the implementation of Part D, for addressing coverage of certain drugs that could potentially see overlapping coverage under Part B and Part D. The report, titled Report to Congress: Transitioning Medicare Part B Covered Drugs to Part D and issued in 2005, did not include specific recommendations for moving products covered under Part B to the Part D benefit, citing the need for at least two years of Part D experience.7 Though HHS has not reevaluated this issue, CMS has offered subregulatory guidance regarding which overlapping drugs should be covered by the Part B and Part D benefits, but CMS has not issued formal guidance altering coverage for classes of drugs.8

The Medicare Payment Advisory Commission (MedPAC), an independent advisory arm to Congress, also offered recommendations to clarify existing inconsistencies between Part B and Part D coverage for certain drugs. Their June 2007 report, Promoting Greater Efficiency in Medicare, offered three recommendations:

- Identify overlap drugs covered under Part D most of the time and direct plans to cover them under Part D all of the time;

- Permit Part D plans to cover a transitional supply of overlap drugs until the plan determines if the drug should be covered by Part B or Part D; and,

- Cover appropriate preventative vaccines under Part B.

Congress has not yet passed legislation to address any of these recommendations.

A follow-up MedPAC study, issued in October 2007 and titled Coverage and Pricing of Drugs that Can Be Covered Under Part B and Part D, examined the overlap between Part B and Part D. MedPAC interviewed stakeholders for impressions of policies and experiences with these drugs, analyzed Part D plan data on how these drugs received coverage in 2007, and compared prices paid by the government and beneficiaries when Part B covered a drug to prices in national Part D prescription drug plans. The report is a statement of the issue and does not contain specific guidance or recommendations.10

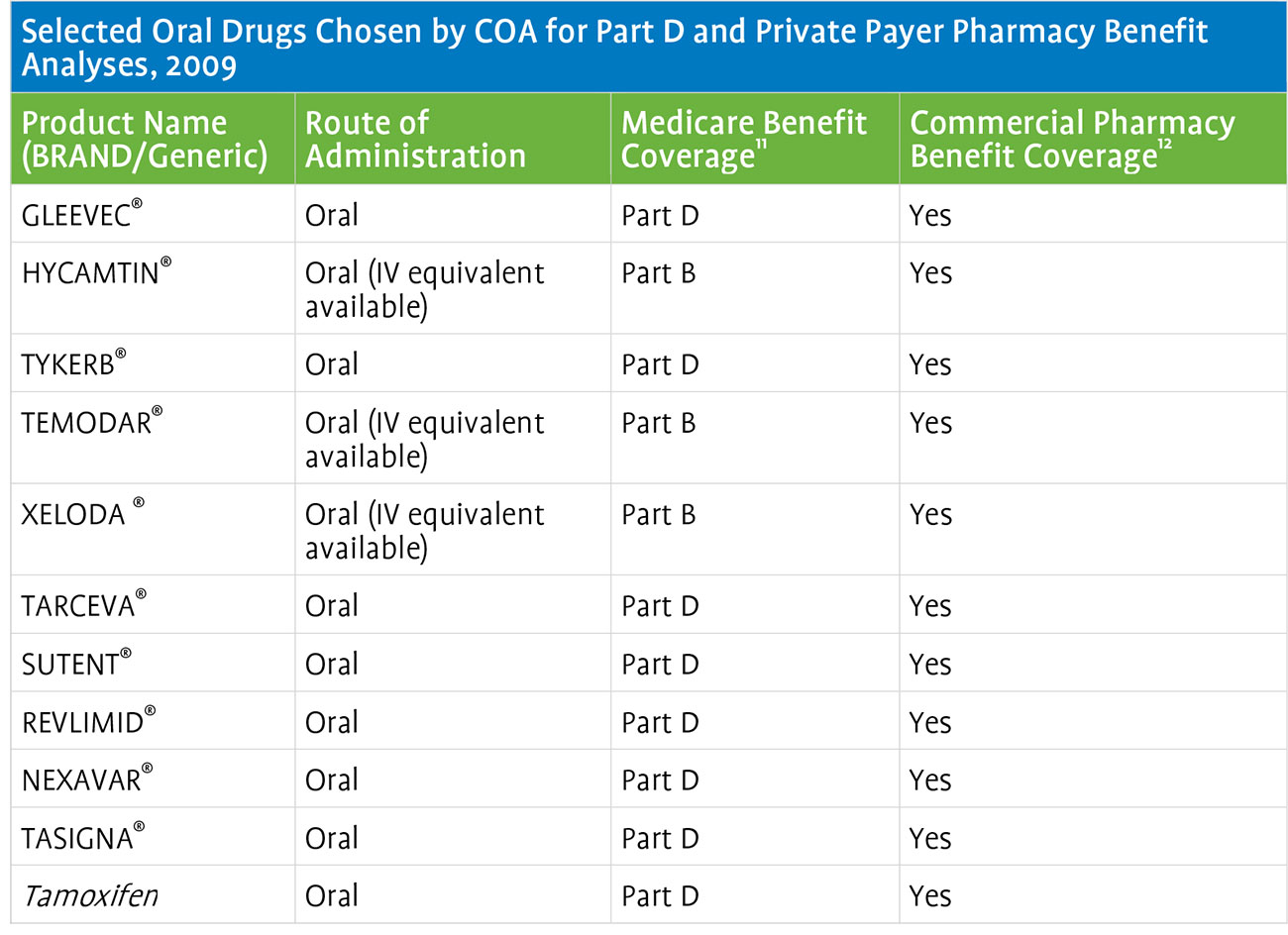

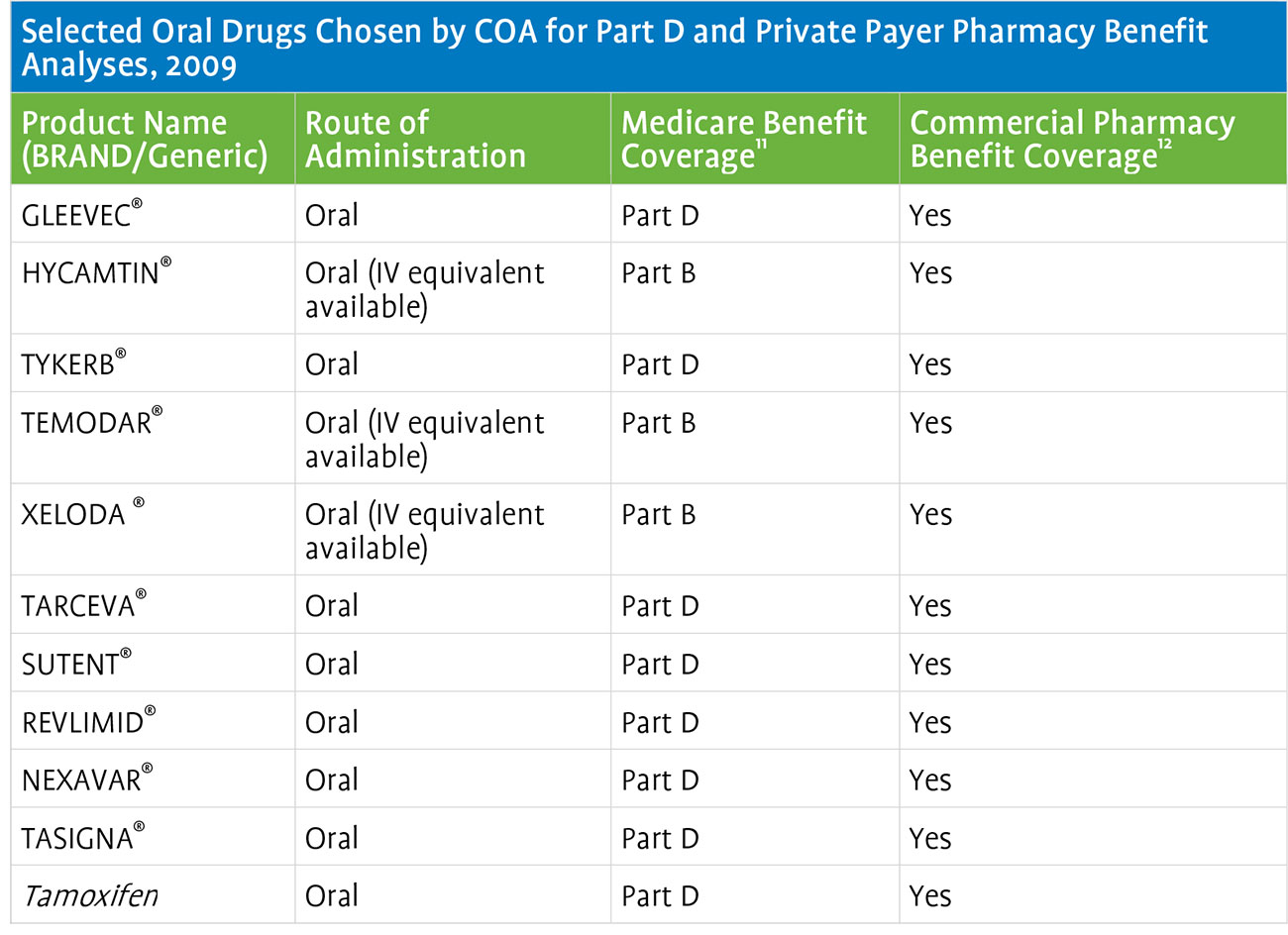

To better understand the fractured coverage environment as it related to oncology products, Avalere reviewed 2009 Medicare Part D plan formularies and formularies of select private payers (Aetna, Anthem BlueCross BlueShield [BCBS], CareFirst BCBS, Cigna, Harvard Pilgrim, and Humana). In particular, Avalere analyzed whether 11 oral oncolytics selected by COA were covered under the plans’ medical versus pharmacy benefit to identify whether private payers administer coverage for oral oncolytics using the model established by Medicare, or if private plans employ a different approach for these therapies. The results show that private payers appear to cover oral oncolytics under the pharmacy benefit, including those that Medicare covers only under Part B. This further illustrates potential confusion associated with prescribing oral oncolytics, as medical versus pharmacy benefit coverage differs depending on whether a patient is a private pay or Medicare patient. An overview of the drugs and plans reviewed is in the table below.

Medicare Part D Benefit Design and Cost Sharing for Oral Oncolytics

Comparing coverage of oral oncology therapies under Medicare Part D reveals varying levels of patient access. A total of 3 of the 11 oral oncolytics analyzed are eligible for Part B reimbursement—XELODA, TEMADOR, and HYCAMTIN. Unsurprisingly, none of these drugs, in their oral forms, are available on Part D formularies.

Of the eight remaining drugs, the most common formulary tier placement was the highest tier, where patients pay a larger portion of a drug’s cost out of pocket. Depending on the insurance plan, this could range from tier three to tier five. These are non-preferred or specialty tiers, with cost sharing ranging from 25 to 35 percent. In 2008, 76 percent of PDPs and 90 percent of MA-PDs used specialty tiers.13 Beneficiaries have the option to appeal cost sharing for drugs placed on non-preferred tiers; however, this option is not applicable for drugs placed on specialty tiers and thus beneficiaries are required to pay the full out-of-pocket requirement.14

REVLIMID offers a telling example of the cost of oral oncolytics for Medicare patients. A patient enrolled in Universal American’s Community CCRx Basic plan taking REVLIMID will enter the coverage gap in filling their first prescription, paying $4,263 out of pocket. The first fill is approximately equal to one month of treatment. The $4,263 includes a deductible of $295 and a 55-percent cost share of the plan’s negotiated drug price of $7,214. Under this plan, in 2009 a beneficiary enrolled in this specific plan would pay $8,678 for a year’s prescription of REVLIMID.

Costs are similar for different benefit designs. For a beneficiary enrolled in a plan employing the standard benefit, such as Universal American’s Prescriba Rx Bronze, and taking REVLIMID, the beneficiary would enter the coverage gap in their third month of treatment. This assumes the patient is not taking any other drugs. Under this plan, a beneficiary would pay $8,318 for a year’s prescription of REVLIMID.

In addition to the difficulty presented by high cost sharing, PDPs have also been increasing their use of utilization management tools, such as prior authorization or step therapy requirements, to more efficiently manage costs. These tools can result in a delay in care for patients as providers and their staff perform the often lengthy process of obtaining the appropriate approvals. For example, the percentage of PDPs requiring prior authorization for Gleevec increased from 40 percent to 76 percent between 2006 and 2009. Likewise, the use of prior authorization by PDPs for Tarceva increased from 41 percent to 68 percent.15 Another important consideration is the lack of consistency related to the documentation or information that each plan requires to approve a prior authorization or satisfy a step therapy requirement. Each plan uses different forms and processes, which further delays the process.

Private Payer Coverage of Oral Oncolytics

Private commercial payers base coverage decisions on three primary factors: safety, efficacy, and cost. Though decisions by other payers, such as Medicare and other private insurance plans often influence coverage decisions, each payer ultimately makes independent coverage decisions. To assess coverage of oral oncology drugs in the private insurance market, Avalere analyzed a sample group of key influential private payers, including 4 national and 2 regional plans, to assess access to the 11 oral oncolytics identified previously.

As the previous table indicates, all of the private health plans cover the 11 drugs reviewed under the pharmacy benefit. As in the Medicare Part D market, private payers employ formulary tiers with different cost sharing for each tier. The private payer analysis revealed that the most common tier placement for the 11 oral oncolytics was tier 2, a preferred brand tier. Medicare Part D plans, on the other hand, place most of these drugs on non-preferred brand tiers.

Unlike in Medicare, private payers do not publicly post cost sharing information for their plans; only members have access to this data. However, an industry report offers insight into average cost sharing for this market. The national average cost sharing for tier two is $25. Additionally, for plans requiring coinsurance, the national average cost sharing for the preferred tier is 21.5 percent of the plan’s contracted price for the drug.16

Issues Arising from Benefit Design

For patients, cost-sharing inequity is the most palpable problem created by the bifurcated coverage of oncolytics. While the medical benefit generally requires coinsurance—20 percent in Medicare Part B—many patients have supplemental coverage that can reduce or even eliminate cost sharing. The same cannot occur in Medicare Part D, which explicitly prohibits supplemental coverage. This is especially difficult for patients taking high-cost drugs such as oral oncolytics because oftentimes these patients will reach the coverage gap.. Additionally, though antineoplastics are part of a CMS-designated “protected class” in Medicare Part D, meaning that plans must cover “all or substantially all” of these cancer-fighting drugs, tier placement is left to the plan. As a result, many of these products are on tiers with coinsurance of between 25 and 35 percent. With no supplemental coverage available, Medicare patients on oral oncolytics frequently shoulder a large financial burden relative to what they might pay under Medicare Part B, one that may even lead some patients to decline care.17 In cases where both oral and IV drugs are available, such as with Revlimid (oral) and Velcade (IV), financial concerns may drive preference toward the IV drug, despite the convenience of taking a pill form of the medication.18

The situation may be no less acute in the private insurance market. While insurers are not as transparent with tiering and cost sharing in their private plans as they are required to be in their Medicare Part D plans, anecdotal evidence suggests that patients in private plans may face high coinsurance as well, sometimes as high as 50 percent.19

In light of these concerns, physicians are reporting that they are more likely to check a patient’s coverage in advance of treatment recommendations and discuss out-of-pocket costs with patients. While a recent survey found that only 46 percent of oncologists discussed out-of-pocket costs with patients in 2007, 67 percent reported doing so in 2008. The same survey found that the percentage of oncologists checking a patient’s coverage doubled between 2007 and 2008, from 27 percent to 53 percent.20

Less financially challenging but no less material is the confusion caused by coverage of certain oral oncolytics under Medicare Part B and others under Medicare Part D. Pharmacists, for instance, are accustomed to working with Medicare Part D plans but are often unfamiliar with the Durable Medical Equipment Medicare Administrative Contractors (DME MACs) that manage oral oncolytics covered under Medicare Part B.21

State and Federal Legislation Aimed at Cost Sharing and Benefit Design

Federal and state legislatures have seen no fewer than 22 bills aimed at addressing the coverage and cost-sharing discrepancies in the current system.22,23,24,25 The most prominent of these legislative efforts is Oregon’s Senate Bill 8, enacted in 2007, which mandates that health plans in the state offer equivalent coverage for oral chemotherapies as for IV chemotherapies.26 At the federal level, Rep. Brian Higgins (D- NY) introduced a similar bill on May 12, 2009.27

Patient Assistance Programs

Patient assistance programs (PAPs), which are manufacturer-sponsored or independent charitable organizations, are one resource available to help patients meet the high cost of cancer care. However, the usefulness of PAPs is limited by their complexity—most have applications with reading levels greater than those suggested for patients with low health literacy—and lack of portability (many PAPs are specific to one or a few products). This problem is intensified by the fact that many cancer patients take multiple high-cost drugs and may need to apply for multiple PAPs.28 In addition, the eligibility criteria and enrollment period vary by PAP program, so patients cannot be assured qualification for a PAP for each of their therapies nor for an extended period of time (e.g., some PAPs award funding monthly versus annually). PAPs though are generally designed for those without insurance, not the under-insured, so the programs may not be a viable source of assistance for all patients.

Issues Arising from Reimbursement

Physician reimbursement can also have an unfavorable impact on access to oral oncolytics. Oncologists provide many unreimbursed services, such as treatment planning and management, patient education, social work, care coordination, compliance management, financial counseling, and end-of-life planning. When administering IV oncolytics, oncologists can realize reimbursement for administering the drug. While the payments associated with these codes do not cover treatment planning, side effect management, and other important services that oncology practices provide, they may help to offset the cost of these services. However, when a patient receives an oral oncolytic, the practice still provides the same services, sometimes via the phone and after normal business hours, but receives no reimbursement to help cover the associated costs.

Reimbursement also challenges pharmacies and facilities. For instance, a community pharmacy may purchase a bottle of oral oncolytics, dispense some of them, and then be left with half of a bottle of expensive pills that they cannot sell, either because of lack of demand or product expiration. Facilities, especially smaller and more rural facilities, confront the same issue. This is a major concern since most patients receive their cancer care in the community setting as opposed to the academic medical center.

In addition to these costs associated with providing quality cancer care, practices and pharmacies are increasingly spending valuable time on paperwork. This is especially true for oral oncolytics, which often have more prior authorization requirements and other utilization management tools placed on them compared to their IV counterparts. The cost of navigating insurance requirements is significant. A recent study concluded that physicians spend 2-3 hours per week working with health plans while their nurses spend nearly 20 hours per week and clerical staff nearly 30 hours per week on these tasks.29

Oncologists report that these reimbursement issues are not minor nuisances but problems that may threaten practice viability. A recent survey from US Oncology addressed overall reimbursement and found that 39 percent of oncologists reported a significant decrease in reimbursement from 2006 to 2008 while another 39 percent reported a small drop in reimbursement over this period. Only 10 percent of oncologists reported a rise in reimbursement.30

Further complicating the oncology landscape is the fact that there are different reimbursement mechanisms for IV versus oral products. Providers must purchase the IV drug from a manufacturer or distributor, administer it to the patient, and then bill the patient’s insurance for the product. Providers are then reimbursed for the drug based on a fee schedule—Average Sales Price plus 6 percent for Medicare, often higher for private insurance. In contrast, when prescribing oral oncolytics the provider does not purchase the product; therefore, the provider does not seek reimbursement from the payer. The next section provides some clarity on the different approaches patients, payers, and providers use in real-life practice to overcome many of the challenges presented here.

Section 2: Issues Map, Key Findings from Interviews, and Best Practices

Issues Map and Key Findings from Interviews

At the onset of this project, Avalere convened a diverse group of stakeholders and conducted a brainstorming session to identify the key issues that community oncology practices face today. The result of this session was an issues map that organized the challenges into five main categories. The five categories, along with the questions and considerations related to each category, are outlined below. This issues map was used as the basis for the stakeholder interviews and also served as a guidepost for ensuring that areas of engagement developed at the culmination of the project truly spoke to the needs of this community of providers.

- Administrative – what administrative functions must an oncology practice perform and do these services differ for oral versus IV oncolytics?

- Clinical – what are the clinical considerations when prescribing oncolytics, particularly when determining what formulation to prescribe?

- Compliance – how does patient compliance and side effect monitoring differ for oral versus IV oncolytics?

- Patient Experience – how do patients feel about the flexibility afforded by and responsibility required by oral oncolytics?

- Reimbursement – do reimbursement systems for oral and IV oncolytics affect a physician’s prescribing decisions?

Primary interviews conducted across the spectrum of stakeholders affected by barriers to access for oral oncolytics made up a key component of this research project. Avalere interviewed 49 stakeholders representing community oncologists; oncology nurses; oncology practice administrators; pharmacists; patient groups and patient assistance programs; specialty pharmacies and distributors; and private payers. The thoughts and ideas outlined in the issues map shaped the interviews and offered a unique perspective into the manifestation of these issues into the day-to-day operations of community oncology offices and the patients they treat. In addition, Avalere solicited feedback from each stakeholder as to what changes could be made to the current system to remove the access barriers for oral oncolytics. Findings from the stakeholder interviews were used to identify best practices and inform the areas of potential engagement that Avalere ultimately recommended for the oncology community to consider in mitigating the barriers to access for oral oncolytics. The best practices are presented after the interview findings and the selected options are detailed in the following section. An overview of the stakeholder interviews is included below.

Administrative Issues

The administrative burdens, such as benefits investigations and prior authorization paperwork, associated with prescribing oral oncology agents were consistently described as problematic. Practices noted a higher prevalence of utilization management (UM) tools, such as step therapy, quantity limits, and prior authorization, for oral drugs covered under the pharmacy benefit. Each of these UM tools add a layer of complexity that practices must navigate before the patient can obtain access to the prescribed drug. Practices said they spend a great deal of time completing the paperwork associated with each of these requirements. Assisting patients with the process for applying to, and obtaining product from, different PAPs is also time-intensive. PAP forms are not standardized across organizations or products and eligibility criteria also vary. In addition to the oncology practices, pharmacists also spoke of having to help patients with PAP paperwork. Some stakeholders suggested that the existence of a universal PAP form would significantly ease the administrative burdens they face on a daily basis. Many practices interviewed employ at least one full-time person dedicated to working on administrative activities (e.g., insurance issues, PAP, and copay foundation forms).

Private payers stated that UM tools are used to help control costs and ensure appropriate off-label use. Moreover, they maintained that most prior authorizations are approved within 24 hours. Hence, they did not see these tools as presenting nearly the level of administrative burden that providers felt.

Specialty pharmacies have attempted to assume some administrative functions for oncology offices, but stakeholders had varying opinions on their effectiveness. While specialty pharmacies believe they help alleviate some of the administrative burden associated with oral oncolytics, some oncology practices disagreed, stating that the specialty pharmacies have limited interaction with the oncology practice and are thus of limited benefit. Specialty pharmacies, however, recognize the high communication needs, with one stating, “It is important to build relationships with practice administrators and nurses to help in the best way possible. We can also assist with PAP [and] copay foundations.” Further refinement and development of communication processes, including consistent interaction between the provider’s office and the specialty pharmacy, may allow specialty pharmacies to solidify their place along the treatment continuum and could be an option for alleviating the administrative burden associated with oral oncolytics.

Clinical Issues

Stakeholders were united in the belief that patients should receive the most clinically appropriate therapy but also recognized that each formulation has challenges and benefits that may affect prescribing patterns. In recent years, providers and their staff have begun to engage with the patient and their caregivers much more during the decision-making process. All involved parties must often make difficult choices when taking into account the burden on everyday life, cost sharing, and side effects associated with available oncology treatments. Oncologists and oncology nurses also said that the reduced face-to-face time available for patients on oral oncolytics makes it more difficult to provide treatment management and side effect management. The infusion time of IV oncolytics, however, affords oncologists and nurses the time to monitor treatment and side effects with the patient.

Unfortunately, administrative hassles associated with oral oncolytics can sometimes affect treatment decisions. For instance, if an oncologist believes that a patient needs to begin drug treatment immediately, he or she may prescribe an IV drug because they are generally available more quickly. However, in-office pharmacies, as pharmacists and practice administrators noted, can eliminate this reason to prefer IV oncolytics.

Cost sharing is another factor complicating clinical decision-making. An oral drug may be more clinically appropriate, but an oncologist must also consider that the patient may decline the drug at the point of sale because of the cost and the oncologist may change the prescribing decision accordingly. Clearly, these confounding factors can complicate an oncologist’s ability to prescribe the most clinically appropriate therapy.

While private payers recognized that reimbursement structures can affect prescribing, they did not believe that reimbursement afforded advantages to one formulation over another. They did recognize, however, that the current mechanisms used for determining reimbursement may need to be revisited as medical advances continue to be made and oral oncolytics become more prevalent in the marketplace. Payers stated that they are more focused on outcomes and are generally supportive of clinical guidelines.

Compliance Issues

All stakeholders agreed that patient compliance as it relates to oral oncolytics is a major concern. While cost is an issue that can affect compliance for both IV and oral oncolytics, it is especially problematic for patients on orals because of the generally higher cost sharing patients experience under the pharmacy benefit. Furthermore, because patients receive IV oncolytics in the oncology office, oncologists can actively monitor patients as they receive their drugs, whereas there is no failsafe way to ensure patient adherence with oral oncolytics. Some practice administrators felt that practices would devote more effort to monitoring compliance with oral oncolytics if resources were available. For example, reimbursement for monitoring patients on oral oncolytics, such as payment for nurse visits or telephone calls, might enable practices to devote more staff time to ensuring compliance. Many stakeholders believe there should be reimbursement for these services, so that practices could allocate a full-time employee to these specific activities.

Payers felt that specialty pharmacies are in a good position to monitor compliance. Some payers have gone as far as to mandate the use of specialty pharmacy programs because of their ability to provide case management services. However, one potential drawback of specialty pharmacies, as one specialty pharmacy representative noted, is the lack of coordination between specialty pharmacies and oncology offices. This issue is particularly acute when a patient may experience a side effect following a visit to the office. The patient may call the office and receive instructions to modify the dosing schedule. A representative from the specialty pharmacy may call the patient later in the day and remind the patient to take the scheduled dose, being completely unaware that the doctor changed the dosing regimen. The patient also may become confused, not knowing whose recommendation to follow. Clearly, this can complicate treatment and lead to potentially dangerous compliance issues for the patient.

Patient Experience Issues

Oral oncolytics can offer a significant quality-of-life benefit for patients because of their convenience. However, for patients to realize the full benefits of oral oncolytics, they need to have a strong support system because of the mental and emotional challenges associated with oral oncolytics. Stakeholders agreed that, all other things being equal, oral oncolytics would be preferred. An oncology nurse said “if the cost issue was erased for orals, there would be more oral use because patients prefer orals for convenience” and a payer representative said, “if all things were equal—outcomes, cost, etc.—the preference would be for a patient to be on an oral but we are not there yet.” As noted by some, certain patients will always prefer the face-to-face interaction with their physician and thus prefer IV oncolytics.

Reimbursement Issues

Oncologists, oncology nurses, and oncology practice administrators all described the transition to ASP-based reimbursement as a watershed moment that has negatively affected oncology practices, with small oncology practices suffering the most. Payment for drugs under previous reimbursement benchmarks, such as Average Wholesale Price (AWP), provided oncologists with a buffer to help cover other services that were not reimbursed, such as treatment planning, pharmacy handling, and telephone assistance with patients. Because of the low margins associated with ASP-based reimbursement, these important, unreimbursed services are no longer subsidized. Pharmacists also mentioned that they sometimes serve as patient educators and act as a point of contact for assisting patients with side effect management. These services, to the extent that pharmacists provide them, also have not been reimbursed.

Private payers, on the other hand, did not support additional payment for treatment planning or patient education. It is important to note that this position stems not from lack of recognition of the services that oncologists provide, but from their view that oncologists receive the same treatment as many other physicians not specifically reimbursed for treatment planning. One private payer stated, “No other specialty gets reimbursed for treating its patients. Why would oncology need to be reimbursed more?” While not strictly accurate—Medicare pays radiation oncologists for treatment planning—this payer’s statement is reflective of the general view of payers toward additional reimbursement for oncology services.31 Other comments from private payers suggested areas of common ground. Payers felt that any additional reimbursement, if agreed to, would have to have a basis in increased quality and improved outcomes. Finally, some payers noted that the reimbursement system is skewed toward IV oncolytics because of the buy and bill method for reimbursement of these products. Some payers have begun to explore alternative reimbursement approaches to address this, but these types of initiatives vary widely.

While all stakeholders agreed that the delivery of oral oncolytics is rife with challenges, some have developed and implemented mechanisms for maximizing access to oral oncolytics within the existing environment. The four best practices identified through the stakeholder interviews are outlined below.

Best Practices

In-Office Pharmacy

An in-office pharmacy enables oncology offices to stock and dispense oncolytics and related supportive drugs (e.g., erythropoiesis stimulating agents, antiemetics). In-office pharmacies, depending on the set-up, may also dispense other non-oncology drugs, which may ease the patient burden of traveling to different pharmacies. Additionally, in- office pharmacies can assist oncology offices with tracking side effects and compliance and can offer providers additional insight into the patient’s entire treatment regimen. The use of an in-office pharmacy can also alleviate patient delays that are sometimes experienced with external distributors.

Importantly, in-office pharmacies allow oncology offices to purchase and receive reimbursement for all oncolytics regardless of formulation. Thus, the office can negotiate with distributors and manage their cash flow on a broader book of business. Furthermore, the physician’s office has real-time access to a patient’s insurance information and can devote resources to identifying financial assistance, rather than having a pharmacy assume these responsibilities. By enabling practices to dispense oral oncolytics directly to patients, in-office pharmacies enhance patient access to oral oncolytics.

Health Plan Consultation with Practicing Oncologist

To help ensure cost-effective, efficacious, and efficient treatment for its members, health plans are becoming increasingly involved in clinical decision-making. As a result, deep understanding of the treatment spectrum for oncology patients is integral to the success of private payers’ oncology initiatives. Ideally, a health plan will include a Medical Director with an oncology specialty on the Pharmacy and Therapeutics (P&T) Committee. If the plan does not employ such a Medical Director, then a consultative relationship with a practicing medical oncologist from the plan’s network is paramount. Additionally, to provide appropriate guidance on treatment pathways, pay-for- performance initiatives, and the processing of UM reviews (e.g., prior authorizations), a formal advisory relationship with established, practicing medical oncologists is a best practice to ensure timely and high-quality decision-making. By consulting with a practicing oncologist with a view of the entire spectrum of medical oncology treatment—that is, both oral and IV drugs—health plans can ensure a balanced review of oral oncolytics.

Dedicated Financial Counselor

Oncology patients face a variety of obstacles at different points during the course of their treatment, such as understanding their insurance benefits, identifying applicable cost sharing for each service, and researching available resources to assist with out-of- pocket costs. In addition, oncology patients often encounter difficulties surrounding the coordination of care outside of the oncology office; therefore, efficient and coordinated care within the oncology office setting is vital to initiating and sustaining high-quality patient care.

A dedicated financial counselor is a key component of the oncology care team, as they serve to coordinate all of the patient’s financial issues. Financial counselors are well versed in the administrative steps associated with insurance coverage, prior authorizations, and other UM tools. In addition, financial counselors have experience with the varying enrollment forms for different assistance foundations. They are also expert at navigating the various copayment assistance programs, many of which run out of funding within the calendar year creating the need to be on the alert for alternative funding sources for patients. During our interviews, Avalere consistently heard that having one dedicated person to assist the patient throughout the entire process of obtaining financial assistance ensures optimal patient access to oral oncolytics.

Health Information Technology and Electronic Medical Record Usage

The use of health information technology (HIT), such as electronic medical records (EMRs), represents an opportunity to address many of the complexities associated with oncolytics, specifically oral formulations. The integration of EMRs within a community oncology office allows for accurate and efficient tracking of a patient’s medical history, treatment planning decisions, patient compliance, and side effects. By providing oncologists with a panoramic view of a patient’s history and treatment, HIT can remove some of the challenges associated with providing cancer care and allow oncologists to focus on treating patients.

HIT and EMRs give providers access to a patient’s comprehensive medical history more easily than a paper record. In late 2008, the American Recovery and Reinvestment Act allocated nearly $19 billion for investment in HIT. These monies will fund incentive payments for providers who adopt HIT systems as well as the development of HIT infrastructure. The incentives are designed to help offset the costs inherent to initial creation of an HIT infrastructure.

Section 3: Areas of Engagement to Consider

In light of the findings from the background research and the stakeholder interviews, Avalere has developed a set of potential areas of engagement that the oncology community can pursue to enhance access to oral oncolytics. Avalere worked with stakeholders to articulate principles to guide the reform efforts and to develop criteria to evaluate the full list of options. From the full range of strategic options, Avalere generated the list, presented below, of the most salient strategies.

Guiding Principles to Ensure Equalized Access for Orals and IVs

Ideally, changes to the coverage and reimbursement system for oral oncolytics would:

- Equalize formulation prescribing incentives;

- Ensure adequate physician payment;

- Increase system efficiency; and

- Optimize patient

Avalere employed these principles in generating the list of potential engagement options.

Evaluation Matrix for Analyzing Reform Options

To make the principles evaluable, Avalere created a list of criteria, which were used to assess each potential area of engagement. The table below shows the evaluation criteria, in descending order of relative importance.

After evaluating all potential options, Avalere developed seven areas for engagement that address the challenges associated with the use of oral oncology agents to ensure physicians have the opportunity to prescribe based on clinical information and outcomes and that patients have access to the therapies they need. The seven areas of engagement are as follows:

- Create one universal enrollment form for all patient assistance programs

- Engage with private payers to improve access to oral oncolytics, streamline

- administrative processes, and equalize coverage between formulations

- Move all oral oncolytics under the medical benefit

- Establish provider reimbursement for oncology treatment planning

- Create an oncology-specific benefit

- Expand access to oncology in-office pharmacies and ensure that private payers contract with such pharmacies

- Develop payer messages regarding the potential issues surrounding the use of episode-of-care (EOC) payment models in oncology.

Section 4: Quantitative Analysis

To supplement the initial findings from the research project, a quantitative study was initiated to examine prescription claims data for 16 oral oncology agents. The analysis was focused on reversal rates for oral oncolytics at the point of sale, reasons for claim rejection, and levels of patient cost sharing. The data used for this analysis was obtained from Wolters Kluwer and included patient-level pharmacy and medical claims information for more than 500,000 patients, representing 5 million prescriptions for oral oncolytics prescribed from April 2007 through June 2009.

Specifically, Avalere analyzed reversal rates associated with oral oncolytics. Using the Wolters Kluwer dataset, we identified 143,000 reversals associated with 16 specific oral oncolytics. The analysis identified what occurred following a claim reversal including the number of patients who: ultimately received the same oral; followed up with different oral oncolytic; followed up with a newly prescribed IV oncolytic; followed up with a previously prescribed IV oncolytic; and did not follow up at all within a 36-day period from date of reversal. The analysis identified a significant number of patients with a reversed oral oncolytic claim who opted for no follow-up treatment. The quantitative analysis illustrated the complexity associated with treatment planning for patients on prescribed oral therapies.

Conclusion

Oral oncolytics offer patients ease of administration and the convenience of treatment at home. A larger proportion of cancer patients currently benefit from this valuable therapy, but significant access issues remain. With 25 percent of the oncology drug pipeline in oral form, use of oral oncolytics will only grow. Unfortunately, the existing healthcare system is ill-equipped to handle the growing oral oncolytics market. Patients and providers face administrative burdens associated with UM tools, PAP forms, and elevated patient cost sharing. A bifurcated drug coverage environment frequently introduces artificial incentives to use IV oncolytics over oral oncolytics because of higher cost sharing under the pharmacy benefit. Practices are paid for IV oncolytics and their administration but receive no reimbursement for prescribing oral oncolytics, even though they provide the same support services and must spend considerable time completing paperwork so that patients can access their therapy. Pharmacists are also taxed by the administrative work necessary to deal with insurance plans and patient assistance programs.

These challenges and others discussed in this report paint a vivid portrait of access challenges that the current system poses for oral oncolytics. It also points to opportunities for reform to ensure patients receive the most clinically appropriate oncolytic. Our report suggests best practices that can see immediate implementation to help mitigate these difficulties, and when paired with longer-term areas of consideration for the oncology community, may ultimately help to ensure that patients can consistently access the right therapy at the right time.

Oral Oncolytics / Addressing the Barriers to Access and Identifying Areas for Engagement

The Community Oncology Alliance (COA), working with Avalere Health, undertook a research effort to assess the current oncology landscape and identify barriers to the uptake of oral oncology agents. The overall objective of this engagement was to examine access challenges related to oral oncolytics and assess ways to potentially mitigate these challenges to ensure that physicians can prescribe the most clinically appropriate oncolytic for a patient, regardless of drug formulation, which is in the best interest of all stakeholders.

To achieve the goals and objectives of this research effort, Avalere conducted a broad range of activities, including a literature review, an analysis of public and private payer policies and claims activity, and stakeholder interviews. We then translated the key findings from the research into a set of materials describing current best practices that oncology offices and payers use to afford patients access to oral oncolytics. The culmination of the research is a set of options that stakeholders should consider when addressing the access barriers facing oral oncolytics. As a supplement to initial findings of this endeavor, we initiated a quantitative analysis to obtain further insight into patient behaviors as it relates to oral oncolytics.

Avalere identified numerous access challenges, for example, the bifurcated insurance benefit design and its’ affect on disparate patient cost-sharing. Additionally, providers are faced with declining reimbursement for drugs but face increasingly complex patients and treatment decisions. As a result, Avalere identified four existing best practices that oncology offices and payers can implement to ensure patient access to oral oncolytics:

- In-Office Pharmacy

- Health Plan Consultation with Practicing Oncologist

- Dedicated Financial Counselor

- Health Information Technology and Electronic Medical Record Usage

Avalere also identified several potential areas of engagement and utilized several evaluation criteria to select seven areas of engagement for stakeholders to consider when addressing access barriers to oral oncolytics. The seven areas of engagement are:

- Create one universal enrollment form for all patient assistance programs

- Engage with private payers to improve access to oral oncolytics, streamline administrative processes, and equalize coverage between formulations

- Move all oral oncolytics under the medical benefit

- Establish provider reimbursement for oncology treatment planning

- Create an oncology-specific benefit

- Expand access to oncology in-office pharmacies and ensure that private payers contract with such pharmacies

- Develop payer messages regarding the potential issues surrounding the use of episode-of-care (EOC) payment models in oncology.

In summary, oral oncolytics offer patients ease of administration and the convenience of treatment at home. A significant proportion of cancer patients currently benefit from this valuable therapy, but significant access issues remain. With 25 percent of the oncology drug pipeline in oral form, use of oral oncolytics will only grow. Unfortunately, the healthcare system is ill-equipped to handle the growing oral oncolytics market. The challenges discussed in this report paint a vivid portrait of access challenges that the current system poses for oral oncolytics. It also points to opportunities for reform to ensure patients receive the most clinically appropriate oncolytic. Our report suggests best practices that can be immediately implemented to help mitigate these difficulties, and when paired with longer-term areas of consideration for the oncology community, may ultimately help ensure patients can consistently access the most clinically appropriate therapies to treat their disease.

Project Overview

The Community Oncology Alliance (COA), working with Avalere Health, undertook a research effort to assess the current oncology landscape and identify barriers to the uptake of oral oncology agents. The overall objective of this engagement was to examine access challenges for oral oncolytics and assess ways to potentially mitigate these challenges to ensure that physicians can prescribe the most clinically appropriate oncolytic for a patient, regardless of drug formulation, which is in the best interest of all stakeholders.

To achieve the goals and objectives of this research effort, Avalere conducted a broad range of activities, including a literature review, an analysis of public and private payer policies and claims activity, and stakeholder interviews. We then translated the key findings from the research into a set of materials describing current best practices that oncology offices and payers use to afford patients access to oral oncolytics. The culmination of the research is a set of options that stakeholders should consider when addressing the access barriers facing oral oncolytics. As a supplement to initial findings of this endeavor, we initiated a quantitative analysis to obtain further insight into patient behaviors as it relates to oral oncolytics. We outline the results and key findings of the research in the remainder of this paper’s five sections as described below.

Section 1 presents the issues relevant to the use of oral oncolytics in cancer treatment and describes the challenges that each oncology stakeholder faces regarding access to oral oncolytics. In addition, it summarizes our findings from a review of the published literature and analysis of current activities within the oncology community relating to access to oncology treatments. To evaluate the current landscape for oral oncolytics and identify barriers to access, Avalere examined coverage policies and formularies for selected commercial health plans, Parts A and B Medicare Administrative Contractors (MACs), and Medicare Part D plans. We also reviewed reports, proposals, and activity from relevant groups such as the Centers for Medicare & Medicaid Services (CMS) and the Medicare Payment Advisory Commission (MedPAC).

Section 2 comprises: (1) an issues map that delineates the current issues affecting access to oral oncolytics and (2) a set of best practices, which describe effective strategies for enhancing access to oral oncolytics within the current system, absent broader system reform. Both of these documents reflect substantive input from interviews with a large and diverse group of stakeholders. In total, Avalere interviewed 54 entities intimately familiar with the provision of oncology care. This group included 11 community oncologists, 8 oncology nurses, 3 oncology practice administrators, 7 pharmacists, 4 patient groups and patient assistance programs (PAPs), 4 specialty pharmacies and distributors, 5 manufacturers, and 12 private payers.

Section 3 outlines seven options that the oncology community should consider pursuing to remove existing access barriers to oral oncolytics. Avalere collated input from the stakeholder interviews, COA’s Oral Oncolytics Working Group, and internal expertise to develop a comprehensive set of potential focus areas that if pursued, could improve patient access. This initial assessment yielded 27 potential areas for engagement. Avalere then critically evaluated each potential engagement area across a variety of criteria to identify a subset of actionable strategic initiatives for the oncology community to consider pursuing in its collective effort to ensure optimal care for cancer patients. We evaluated the initiatives against certain criteria including (1) breadth of impact (i.e., how effective the initiative would be in mitigating access concerns for oral oncolytics), (2) challenges to implementation (i.e., how difficult would it be to gain stakeholder consensus and the action necessary for enactment), and (3) resources required to implement the initiative (i.e., what other resources would be needed to implement a set of steps, either monetary resources or alignment with other, diverse stakeholder groups). The full list of criteria will be described later. Avalere quantified each of the individual criteria to cull the list of 27 to a list of the 7 recommended areas of engagement.

Section 4 provides a summary of the preliminary findings of the follow-on quantitative project. Avalere conducted an analysis of data provided by Wolters Kluwer to obtain a more robust understanding of patient behavior at the point of sale for oral oncolytics. Specifically, Avalere explored the rates of reversal for oral oncology agents, the reasons for rejection at the payer level, and the level of cost sharing that patients face for oral oncolytics.

Finally, our conclusion offers recommended next steps for the oncology community to consider undertaking to mitigate access barriers for oral oncolytics. In addition, the conclusion offers an overview of current developments in health reform that could directly impact the oncology community and, more specifically, access to oral oncolytics.

Section 1: Why Oral Oncolytics Matter and Current Challenges Associated with Access

Why Is There Concern About Access to Oral Therapies?

Oral oncolytics can offer patients greater flexibility than IV oncolytics but also present unique challenges to physicians, patients, pharmacists, health insurers, and other stakeholders. In particular, the availability of oral and IV drugs within the same therapeutic class and the existence of oral and IV formulations of certain drugs complicates physician decision-making.

In addition to purely clinical considerations, there are non-clinical factors that can affect therapy selection. An oral oncolytic may be most clinically appropriate for a patient, but compliance concerns with oral drugs may lead the physician to prescribe an IV oncolytic instead because of the greater control over delivery afforded by IV drugs administered in a medical office.

While compliance is a concern for all oral drugs, it is particularly relevant for oral oncolytics because of some of the side effects associated with these products. Because oral oncolytics are taken outside of the office setting, providers are unable to closely monitor the side effects. Additionally, without the daily or weekly interaction that occurs between patient and provider when receiving IV infusions, patients may independently alter the dose of an oral oncolytic to reduce side effects, never apprising the provider of the change to their dosing schedule. Furthermore, cost sharing can contribute to compliance concerns with oral oncolytics because many of these drugs are often subject to higher patient cost sharing than related IV oncolytics.

Physicians and pharmacists also face administrative battles when prescribing and dispensing oral oncolytics. A health plan’s greater ability to manage oral drugs as compared to IV drugs translates into increased paperwork for the physicians that prescribe and pharmacists that dispense oral drugs.

Finally, many stakeholders believe that because providers are reimbursed directly when using IVs, they may have a financial incentive to use the IV product instead of an oral. However, providers disagree, saying there is little to no financial incentive for IVs because providers are not fully compensated for the components of care required to deliver IV oncolytics, nor does the reimbursement for the drug always equal the cost of the product.

These challenges might seem inconsequential if they affected only a few patients or products, but with oral oncolytics representing an increasing portion of oncolytic prescriptions and approximately 25 percent of the oncology drug pipeline, they are challenges very much of the present.1

Challenges Facing Oral Oncolytics

The existing infrastructure of insurance benefit design contributes significantly to the access issues patients encounter when attempting to obtain oral oncology agents. Medicare and most other insurers have separate medical and pharmacy benefits. The medical benefit generally covers hospital visits and physician services, including physician-administered drugs. The pharmacy benefit generally covers drugs that a patient self-administers, such as pills and some subcutaneous injectables. This bifurcated insurance landscape can create artificial incentives and disincentives to use certain products. Further, variance in patient cost sharing can challenge patients financially, and some patients may have only medical benefit coverage, cutting them off from therapies covered in the prescription drug benefit. Medicare, with Parts A, B, and D, offers a striking example of the complexity of today’s insurance market and showcases the difficulties that patients experience interacting with these entities.

Part B: Physician-Administered Drug Coverage

The establishment of Medicare Part B took place at the inception of the Medicare program in 1965. The Social Security Act defines drugs covered under Medicare Part B as those furnished “incident to” a physician service that are not usually self-administered by the patient.2 The Centers for Medicare & Medicaid Services (CMS) currently defines IV and intramuscular (IM) injections as not usually self-administered. Conversely, oral drugs are considered usually self-administered and as such, Medicare Part B does not cover them, with rare exceptions.

Though Part B generally only covers drugs administered “incident to” a physician service and not self-administered drugs, Congress extended Medicare Part B coverage to certain oral anticancer drugs in the Omnibus Budget Reconciliation Act of 1993 (P.L. 103-66).3 The basis for this coverage expansion was the fact that Part B covered the IV formulations of these drugs and Congress wanted to ensure that Medicare beneficiaries could access the oral formulations as they came to market. Medicare Part D (i.e., the pharmacy benefit) had not yet come about and Congress’s extension of coverage to this limited number of oral oncolytics acted as a patch to the system.

CMS later expanded Medicare Part B coverage to prodrugs, which are pharmacologically inactive substances that are the modified forms of pharmacologically active drugs to which they are converted (as by enzymatic action) in the body. This expansion resulted in coverage for eight oral oncolytics: ALKERAN® (melphalan), HYCAMTIN® (topotecan hydrochloride), MYLERAN® (busulfan), TEMODAR® (temozolomide), XELODA® (capecitabine), cyclophosphamide, etoposide, and methotrexate.

The table below outlines 2007 Medicare Part B expenditures for the covered oral- anticancer drugs.4

Generally, Medicare patients must pay a 20-percent coinsurance for drugs and their associated administration procedures under Part B. While there is no catastrophic threshold or out-of-pocket maximum for beneficiaries under the Part B benefit, 89 percent of beneficiaries have supplemental coverage that reduces or eliminates the 20- percent cost sharing.5 Depending on their level of insurance coverage, some patients also may be eligible for assistance from copay foundations or manufacturer patient assistance programs.

Medicare Part B covers only eight oral oncolytics. Medicare Part D, which covers all other oral oncolytics, has a significantly different benefit structure than Part B.

Part D Overview: Benefit Design and Cost Sharing

The Medicare Prescription Drug, Improvement, and Modernization Act (MMA) of 2003 (P.L. 108-173) created Medicare’s outpatient prescription drug benefit, known as Part D. The Medicare Part D benefit began in January 2006 and covers most oral drugs not covered under Part B. As outlined below, the structure of Part D is decidedly different from that of Part B.

The MMA authorized CMS to contract with private health plans to administer the drug benefit. Two plan types are available: standalone prescription drug plans (PDPs), which only offer a drug benefit, and Medicare Advantage prescription drug (MA-PD) plans that offer both medical and pharmacy coverage. Of the 26.7 million Medicare beneficiaries enrolled in Part D in 2009, approximately two-thirds are enrolled in PDPs.6

The MMA specified a standard benefit design for Part D plans to follow. The standard benefit includes 25-percent cost sharing for prescriptions, a deductible determined annually by CMS, and a monthly premium determined annually by the plan. Unique to the Medicare Part D market is the coverage gap, commonly known as the “donut hole.” In the coverage gap, beneficiaries must pay 100 percent of the cost of their prescriptions until they reach the catastrophic phase of the benefit, at which point they pay only 5 percent of their drug’s cost.

The majority of Part D plans, however, offer an alternative to the standard benefit design: 90 percent of PDPs and 95 percent of MA-PDs in 2009. Under alternative benefit designs, plans may create formulary tiers, reduce the deductible, or offer enhanced coverage such as coverage in the coverage gap. Plans also have wider latitude over the cost-sharing amounts that patients are responsible for when using this type of benefit structure. All Part D plans, regardless of their benefit design, must cover “all or substantially all” products that fall within six classes that CMS has deemed “protected.” One of the protected classes is antineoplastics. Designation as a protected class may increase coverage of drugs within that class; however, it is particularly noteworthy that the “protected” designation does not dictate tier placement. Thus, Part D plans may still place products in a protected class on a high cost-sharing tier.

Although there are specific policies determining which drugs are covered under Medicare Part B versus Part D, it is not always evident to prescribers, patients, or other stakeholders which product is covered under which benefit, resulting in Medicare Part B versus Part D coverage confusion.

Determining Part B vs. Part D Coverage

Congress knew that confusion would exist in terms of clearly delineating Medicare Part B versus Part D coverage for certain drugs, particularly oral oncolytics. Therefore, the MMA tasked the Secretary of the Department of Health and Human Services (HHS) with developing recommendations, prior to the implementation of Part D, for addressing coverage of certain drugs that could potentially see overlapping coverage under Part B and Part D. The report, titled Report to Congress: Transitioning Medicare Part B Covered Drugs to Part D and issued in 2005, did not include specific recommendations for moving products covered under Part B to the Part D benefit, citing the need for at least two years of Part D experience.7 Though HHS has not reevaluated this issue, CMS has offered subregulatory guidance regarding which overlapping drugs should be covered by the Part B and Part D benefits, but CMS has not issued formal guidance altering coverage for classes of drugs.8

The Medicare Payment Advisory Commission (MedPAC), an independent advisory arm to Congress, also offered recommendations to clarify existing inconsistencies between Part B and Part D coverage for certain drugs. Their June 2007 report, Promoting Greater Efficiency in Medicare, offered three recommendations:

- Identify overlap drugs covered under Part D most of the time and direct plans to cover them under Part D all of the time;

- Permit Part D plans to cover a transitional supply of overlap drugs until the plan determines if the drug should be covered by Part B or Part D; and,

- Cover appropriate preventative vaccines under Part B.

Congress has not yet passed legislation to address any of these recommendations.

A follow-up MedPAC study, issued in October 2007 and titled Coverage and Pricing of Drugs that Can Be Covered Under Part B and Part D, examined the overlap between Part B and Part D. MedPAC interviewed stakeholders for impressions of policies and experiences with these drugs, analyzed Part D plan data on how these drugs received coverage in 2007, and compared prices paid by the government and beneficiaries when Part B covered a drug to prices in national Part D prescription drug plans. The report is a statement of the issue and does not contain specific guidance or recommendations.10

To better understand the fractured coverage environment as it related to oncology products, Avalere reviewed 2009 Medicare Part D plan formularies and formularies of select private payers (Aetna, Anthem BlueCross BlueShield [BCBS], CareFirst BCBS, Cigna, Harvard Pilgrim, and Humana). In particular, Avalere analyzed whether 11 oral oncolytics selected by COA were covered under the plans’ medical versus pharmacy benefit to identify whether private payers administer coverage for oral oncolytics using the model established by Medicare, or if private plans employ a different approach for these therapies. The results show that private payers appear to cover oral oncolytics under the pharmacy benefit, including those that Medicare covers only under Part B. This further illustrates potential confusion associated with prescribing oral oncolytics, as medical versus pharmacy benefit coverage differs depending on whether a patient is a private pay or Medicare patient. An overview of the drugs and plans reviewed is in the table below.

Medicare Part D Benefit Design and Cost Sharing for Oral Oncolytics

Comparing coverage of oral oncology therapies under Medicare Part D reveals varying levels of patient access. A total of 3 of the 11 oral oncolytics analyzed are eligible for Part B reimbursement—XELODA, TEMADOR, and HYCAMTIN. Unsurprisingly, none of these drugs, in their oral forms, are available on Part D formularies.

Of the eight remaining drugs, the most common formulary tier placement was the highest tier, where patients pay a larger portion of a drug’s cost out of pocket. Depending on the insurance plan, this could range from tier three to tier five. These are non-preferred or specialty tiers, with cost sharing ranging from 25 to 35 percent. In 2008, 76 percent of PDPs and 90 percent of MA-PDs used specialty tiers.13 Beneficiaries have the option to appeal cost sharing for drugs placed on non-preferred tiers; however, this option is not applicable for drugs placed on specialty tiers and thus beneficiaries are required to pay the full out-of-pocket requirement.14