New Study Shows Rural Hospitals Benefit Most From Recent 340B and Other Medicare Payment Changes, With Majority Seeing 2.7 Percent Average Payment Increases

2018 OPPS Medicare Part B Payment Impact Analysis

Avalere Health | An Innovation Company

January 2018

This analysis was funded by Community Oncology Alliance (COA). Avalere maintained full editorial control.

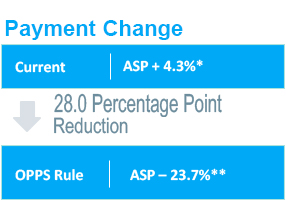

- The CY2018 Medicare Outpatient Prospective Payment System (OPPS) rule reduced Medicare’s payment to hospitals for Part B drugs purchased under the 340B program, effective January 1

- The drug payment adjustment will reduce payments for Part B drugs to the impacted hospitals by the estimated $1.6 billion in 2018, which reflects in government and beneficiary savings

- However, the savings from the 340B payment cut are reallocated to increase reimbursements for other non-drug items and services paid under the OPPS

- CMS estimated that all OPPS payment adjustments for CY 2018 to ~3,900 facilities paid under the OPPS will result in overall increase of approximately $690 million compared to CY 2017 payments¹

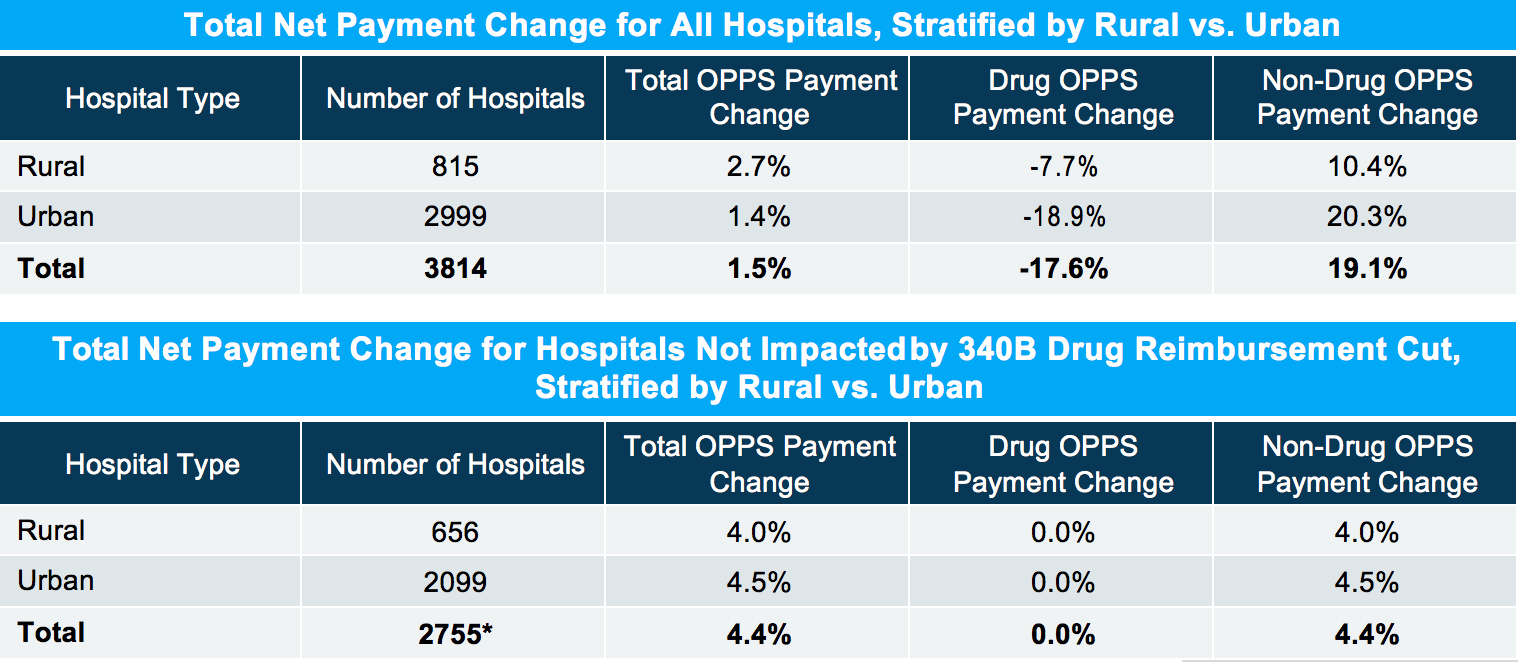

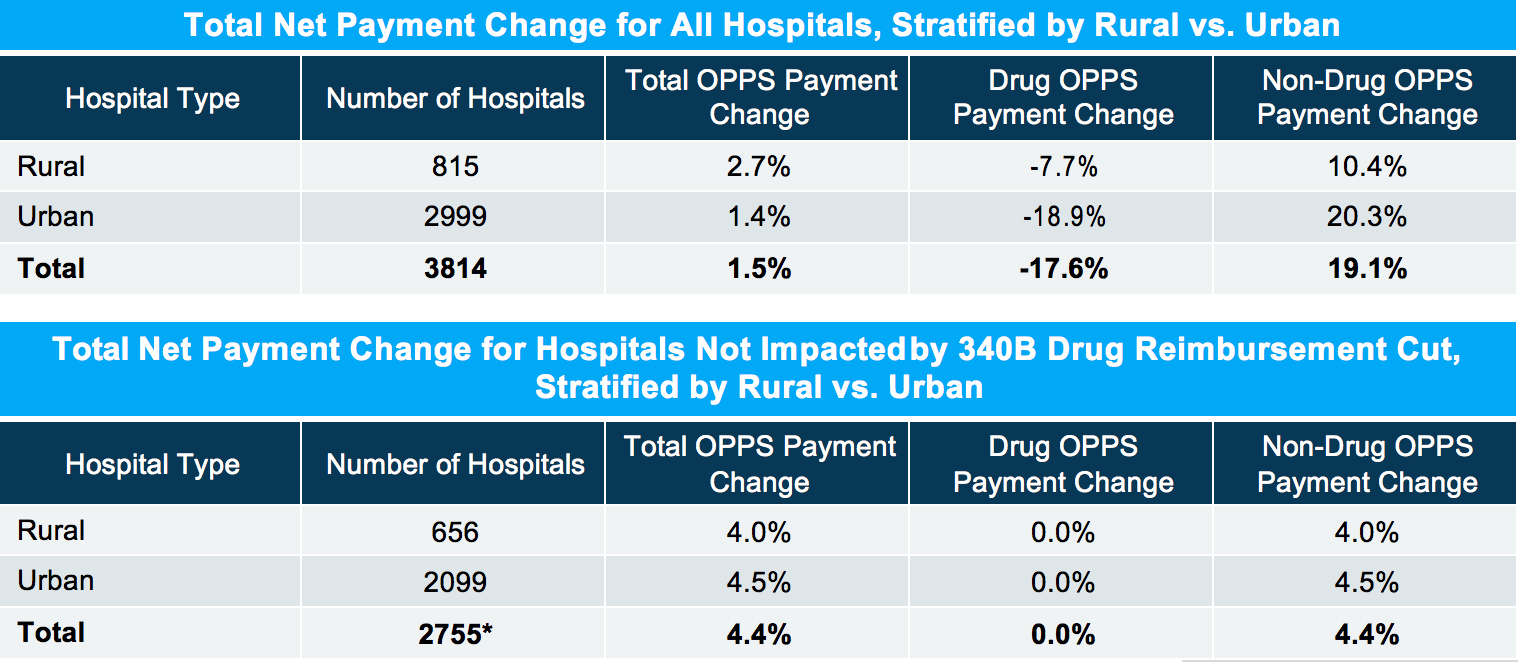

- For all hospitals in aggregate, total OPPS Part B payments are going to increase by 1.5% in 2018, which reflects the estimated 17.6% decrease in Part B drug payments and 19.1% increase in non-drug payments

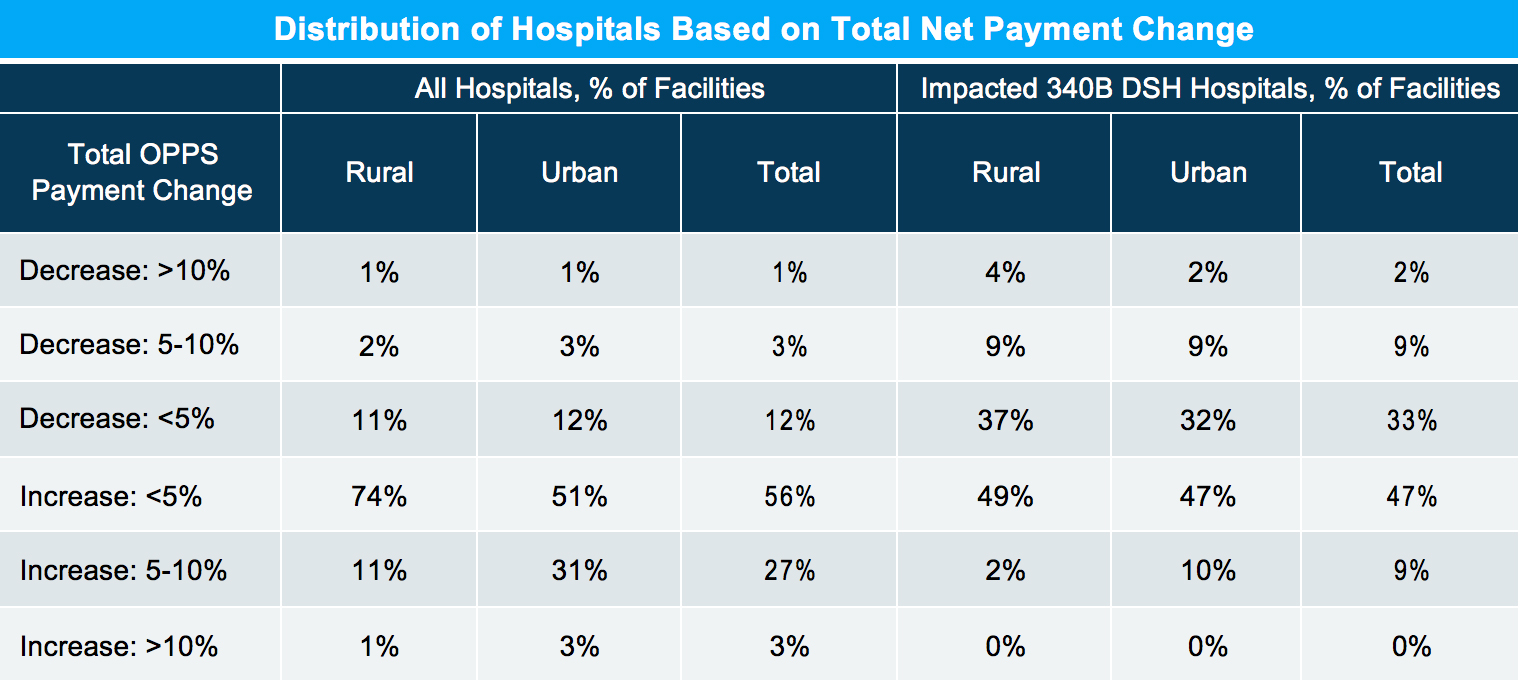

- Among all hospitals, 85% of facilities will see net Part B payment increases as a result of OPPS payment changes

- Only 1% of hospitals will experience net cuts greater than 10% of their Part B revenues

OPPS Part B Payment Adjustment

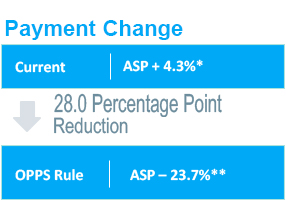

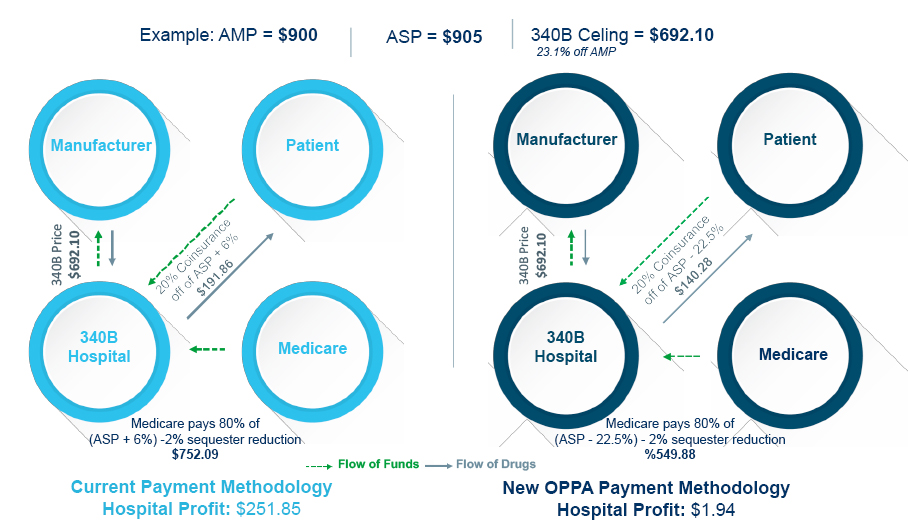

The OPPS Rule Will Reduce Hospital Reimbursement for Part B Drugs Purchased Through the 340B Program

- The CY 2018 OPPS final rule adjusts Part B payments to all separately payable, non pass-through Part B drugs (excluding vaccines) purchased through 340B

- CMS noted the increased number of 340B covered entities, rise of Part B drug prices, and patient coinsurance payments as reasons for the rule

CMS estimates the OPPS payments for separately payable drugs, including beneficiary copayment, could decrease as much as $1.6 billion annually

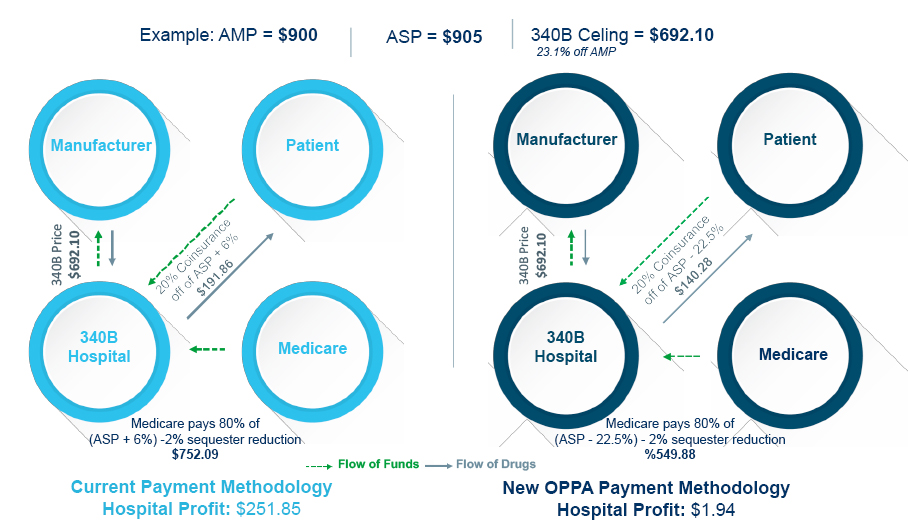

Illustration of a Hospital’s Part B Reimbursement for a 340B-Acquired Drug: Current vs. New OPPS Policy

Net Impact of the CY2018 OPPS Rule

Overall Approach

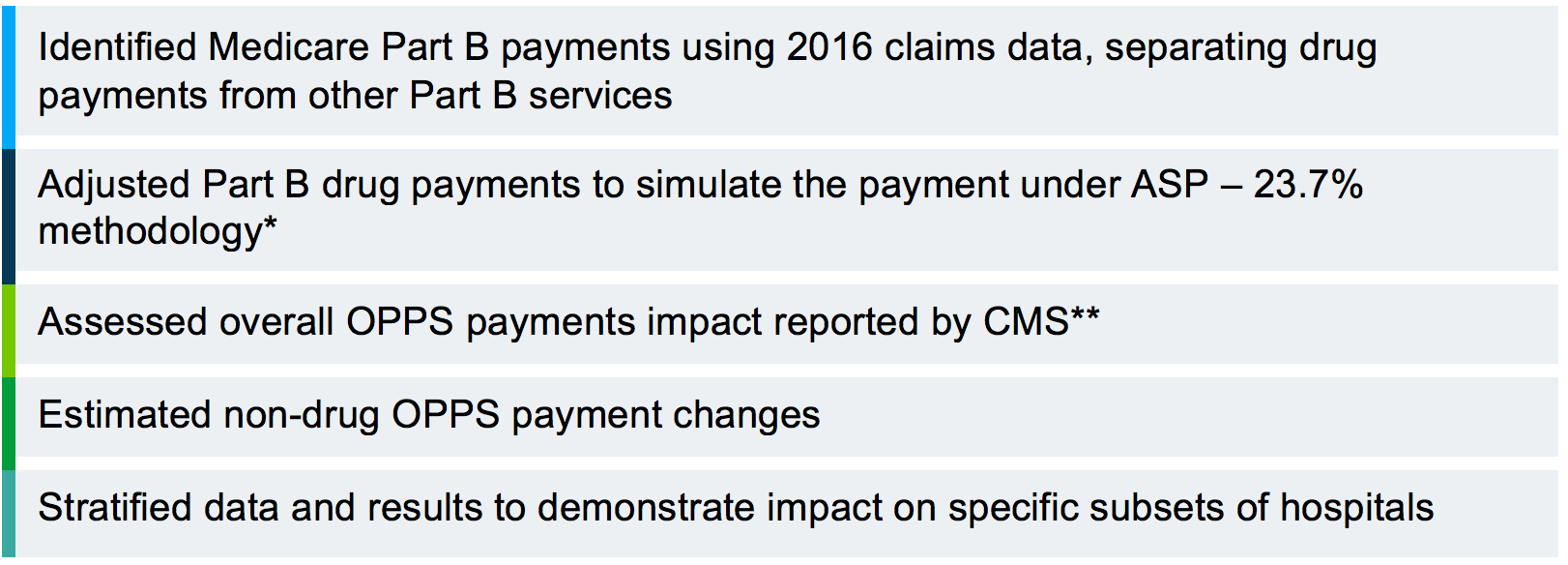

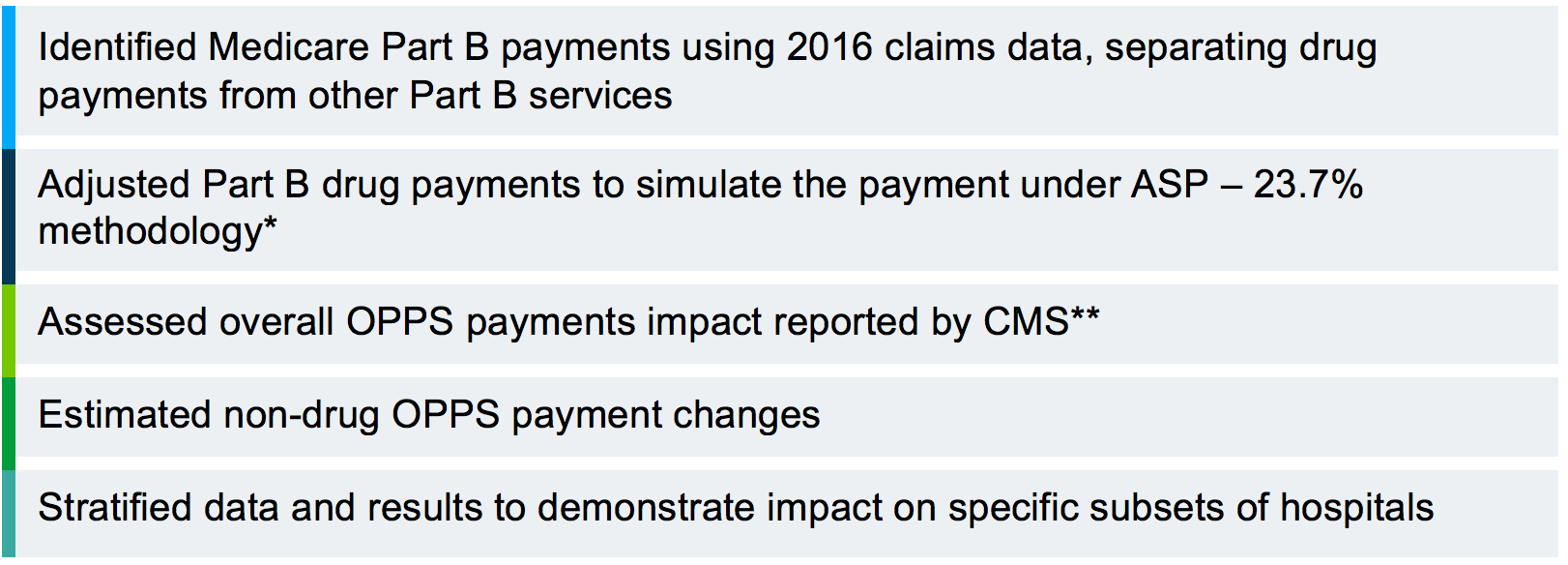

To better understand the overall impact of OPPS Medicare payment adjustments reported by CMS, Avalere modeled Part B drug spending cuts to affected 340B hospitals

In this analysis, Avalere:

Overall, Rural Hospitals Will Benefit Most From OPPS Payment Changes in 2018

80% OF RURAL HOSPITALS WILL NOT BE SUBJECT TO 340B DRUG PAYMENT CUTS FROM MEDICARE

Those hospitals are going to see greater than average overall net payment increase due to OPPS redistribution effects

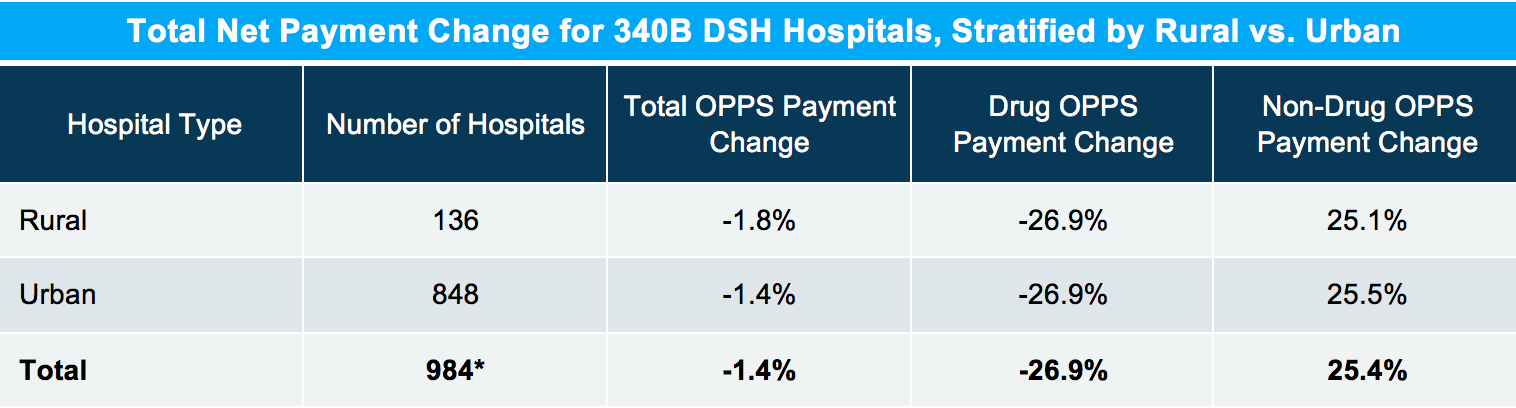

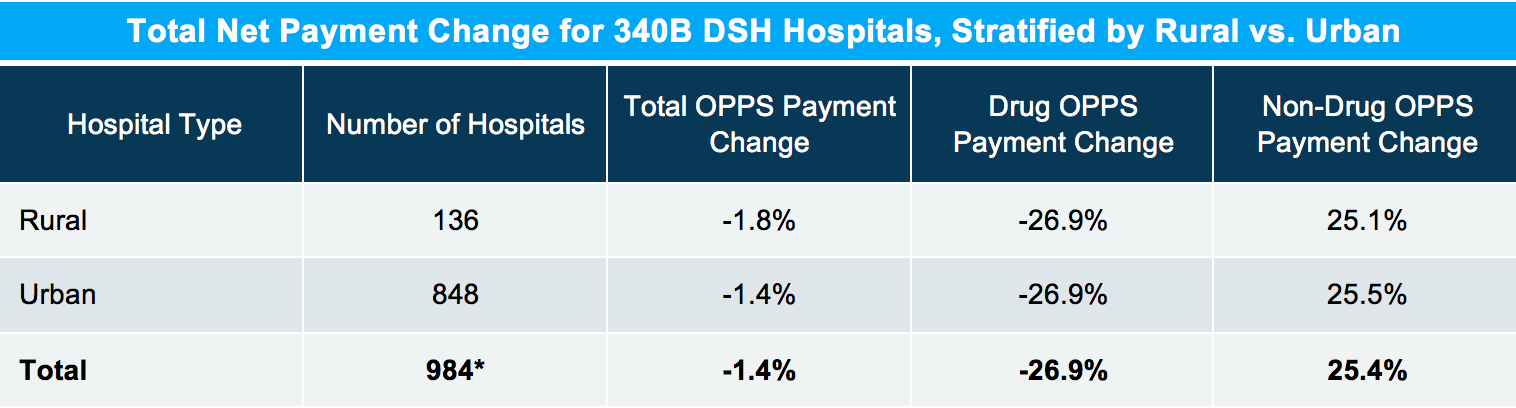

In Aggregate, 340B DSH Hospitals Will See Small Net OPPS Payment Due in 2018

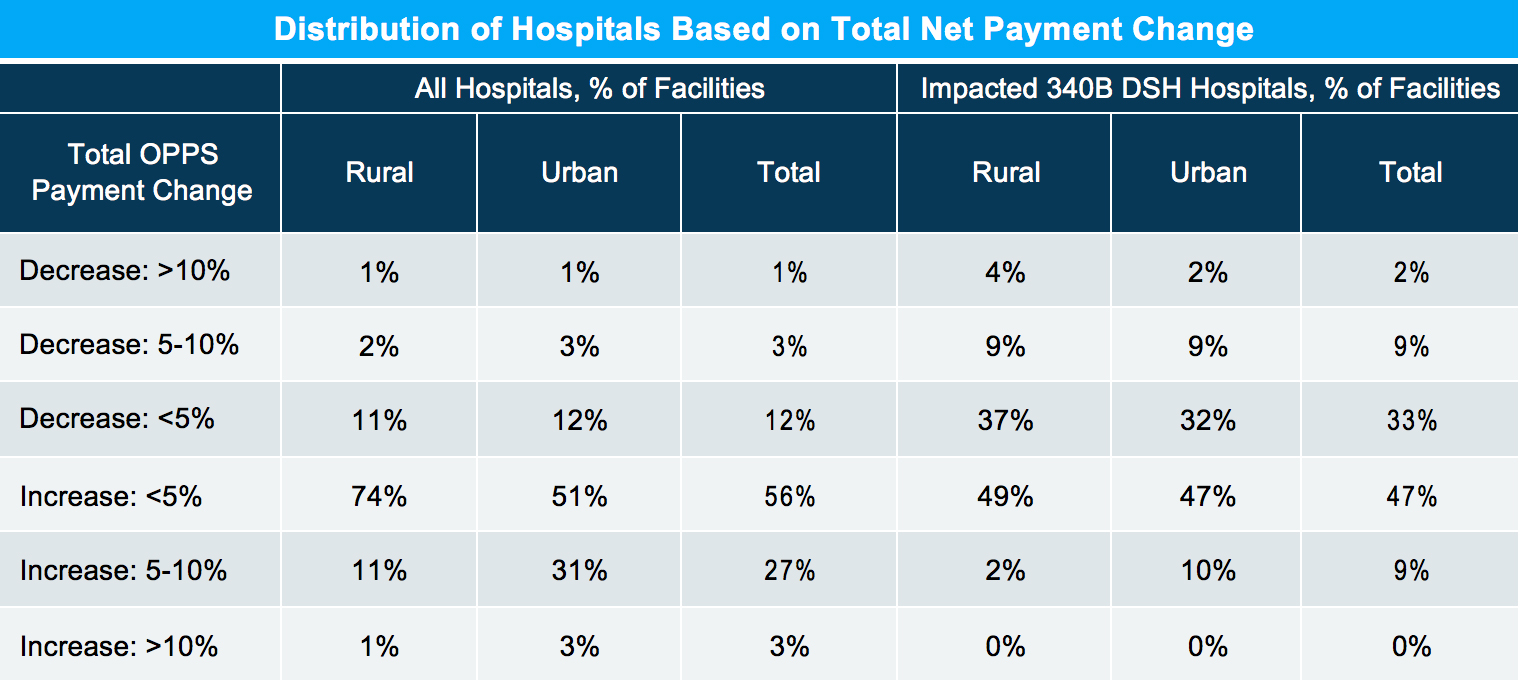

Majority of Hospitals Will See Net Increase in Their 2018 OPPS Payments

Of all hospitals, 85% will see net increase in overall OPPS payments of 340B DSH hospitals, 55% will see net increase in overall OPPS payments

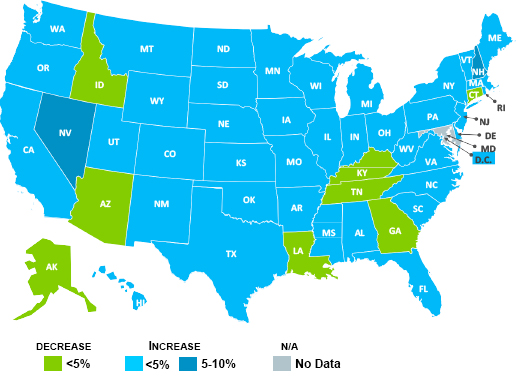

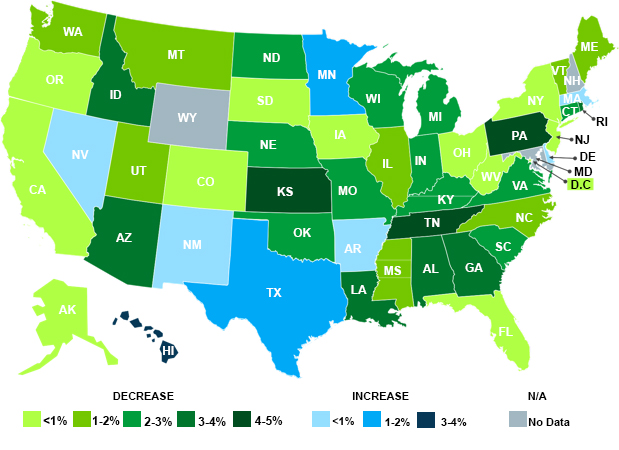

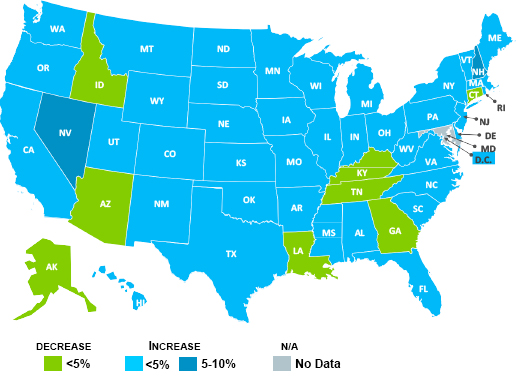

Most States Will See Net Increase in Total OPPS Payments Across All Hospitals in 2018

ONLY 8 STATES WILL SEE NET DECREASE IN TOTAL OPPS PAYMENTS; ON AVERAGE, 0.4%

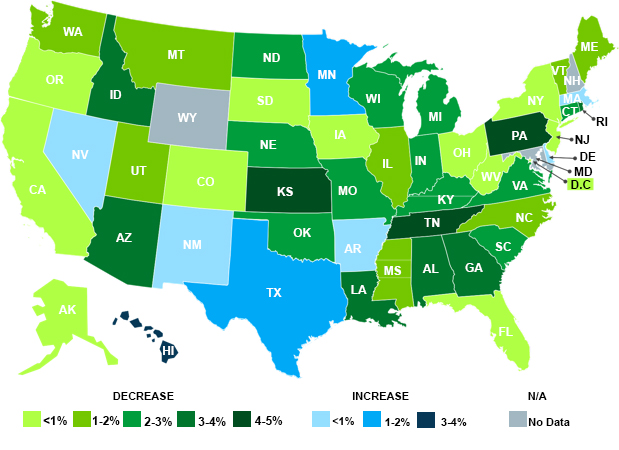

Some States Will See Net Increase in Total OPPS Payments Across Their 340B DSH Hospitals

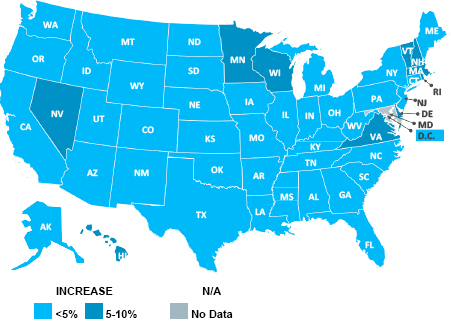

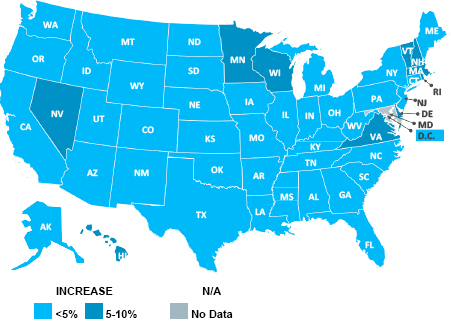

All States Will See Net Increase in Total OPPS Payments Across Hospitals Not Impacted by 340B Drug Payment Cuts

HOSPITALS NOT IMPACTED BY 340B PAYMENT CUTS WILL BENEFIT FROM OPPS REDISTRIBUTION EFFECTS

THE AVERAGE STATE-LEVEL NET INCREASE IN TOTAL OPPS PAYMENTS AMONG THOSE HOSPITALS WILL BE 4.3%

Appendix

Methodology

PART B DRUG SPENDING: Avalere analyzed 2016 Part B drug spending using the Medicare Standard Analytical File (SAF) that includes 100% of fee-for-service (FFS) drug billing by hospital outpatient departments (HOPDs)

PART B DRUG SELECTION: Avalere identified Part B drugs reimbursed by Medicare based on ASP methodology

- J-, Q-, A- and P-codes: Avalere captured all drugs appearing in the quarterly 2016 ASP Drug Pricing Files¹

- Vaccines/Numerical codes: Avalere excluded vaccines per OPPS rule

HOSPITAL SELECTION: Our analysis included 3814 hospitals paid under OPPS, not including 53 children’s and 11 free-standing cancer “held harmless” hospitals that receive proportional adjustments to their OPPS payment rates and are excluded from CMS’ impact file.² Those hospitals are not subject to the part B drug payment reduction even though they are 340B-eligible. Similarly, Critical Access Hospitals and hospitals located in Maryland are eligible for 340B prices but not paid under OPPS methodology.

TOTAL OPPS PAYMENT IMPACT: Avalere analyzed CMS-estimated hospital-level OPPS payments for CY2017 and CY2018 to determine the overall impact of the rule that captures both, 340B drug payment reduction and all other annual payment updates²; CMS’s payment estimates reflect only rate updates and do not include changes in service volume, service-mix, or number of encounters, all of which would affect the actual payments to hospitals.

340B PARTICIPATION: Avalere assessed current (as of January 2018) hospital 340B participation using the 340B Office of Pharmacy Affairs information System (340B OPAIS) from Health Resources and Services Administration (HRSA)

- Source: Centers for Medicare & Medicaid Services. “Calendar Year 2018 Outpatient Prospective Payment System and Ambulatory Surgical Center final rule,” November 2017

ASP: Average Sales Price; CMS: Centers for Medicare & Medicaid Services

*The budget sequestration of 2013 reduced the Part B add-on payment from ASP + 6% to ASP + 4.3%

**The budget sequestration of 2013 would further reduce the proposed Part B payment rate from ASP –

22.5% to ASP – 23.7% 4

Source: Centers for Medicare & Medicaid Services. “Calendar Year 2018 Outpatient Prospective

Example is illustrative only. The ASP payment is split to reflect the beneficiary paying 20% and Medicare paying 80% of drug costs. Medicare payments are adjusted to represent a 2% reduction due to the

sequester (currently ASP + 4.3% and proposed ASP – 23.7%). Beneficiary coinsurance is not impacted by

the sequester. The amounts shown only reflect payments for a specific drug, and does not account for

Note: See Appendix for full description of methodology

*The budget sequestration of 2013 reduced the Part B add-on payment to 4.3%; the sequester would further reduce the proposed OPPS B payment rate from -22.5% to -23.7%

Majority or 92% of hospitals not impacted by the 340B drug reimbursement cut are non-340B; the remaining 8% represent rural sole community hospitals that are 340B program participants but were purposely excluded from thee 340B payment cut.

DSH hospitals represent 93% of all 340B hospitals impacted by OPPS 340B drug payment cuts. Other affected hospitals include rural referral centers and non-rural sole community hospitals.

New Study Shows Rural Hospitals Benefit Most From Recent 340B and Other Medicare Payment Changes, With Majority Seeing 2.7 Percent Average Payment Increases

2018 OPPS Medicare Part B Payment Impact Analysis

Avalere Health | An Innovation Company

January 2018

This analysis was funded by Community Oncology Alliance (COA). Avalere maintained full editorial control.

- The CY2018 Medicare Outpatient Prospective Payment System (OPPS) rule reduced Medicare’s payment to hospitals for Part B drugs purchased under the 340B program, effective January 1

- The drug payment adjustment will reduce payments for Part B drugs to the impacted hospitals by the estimated $1.6 billion in 2018, which reflects in government and beneficiary savings

- However, the savings from the 340B payment cut are reallocated to increase reimbursements for other non-drug items and services paid under the OPPS

- CMS estimated that all OPPS payment adjustments for CY 2018 to ~3,900 facilities paid under the OPPS will result in overall increase of approximately $690 million compared to CY 2017 payments¹

- For all hospitals in aggregate, total OPPS Part B payments are going to increase by 1.5% in 2018, which reflects the estimated 17.6% decrease in Part B drug payments and 19.1% increase in non-drug payments

- Among all hospitals, 85% of facilities will see net Part B payment increases as a result of OPPS payment changes

- Only 1% of hospitals will experience net cuts greater than 10% of their Part B revenues

OPPS Part B Payment Adjustment

The OPPS Rule Will Reduce Hospital Reimbursement for Part B Drugs Purchased Through the 340B Program

- The CY 2018 OPPS final rule adjusts Part B payments to all separately payable, non pass-through Part B drugs (excluding vaccines) purchased through 340B

- CMS noted the increased number of 340B covered entities, rise of Part B drug prices, and patient coinsurance payments as reasons for the rule

CMS estimates the OPPS payments for separately payable drugs, including beneficiary copayment, could decrease as much as $1.6 billion annually

Illustration of a Hospital’s Part B Reimbursement for a 340B-Acquired Drug: Current vs. New OPPS Policy

Net Impact of the CY2018 OPPS Rule

Overall Approach

To better understand the overall impact of OPPS Medicare payment adjustments reported by CMS, Avalere modeled Part B drug spending cuts to affected 340B hospitals

In this analysis, Avalere:

Overall, Rural Hospitals Will Benefit Most From OPPS Payment Changes in 2018

80% OF RURAL HOSPITALS WILL NOT BE SUBJECT TO 340B DRUG PAYMENT CUTS FROM MEDICARE

Those hospitals are going to see greater than average overall net payment increase due to OPPS redistribution effects

In Aggregate, 340B DSH Hospitals Will See Small Net OPPS Payment Due in 2018

Majority of Hospitals Will See Net Increase in Their 2018 OPPS Payments

Of all hospitals, 85% will see net increase in overall OPPS payments of 340B DSH hospitals, 55% will see net increase in overall OPPS payments

Most States Will See Net Increase in Total OPPS Payments Across All Hospitals in 2018

ONLY 8 STATES WILL SEE NET DECREASE IN TOTAL OPPS PAYMENTS; ON AVERAGE, 0.4%

Some States Will See Net Increase in Total OPPS Payments Across Their 340B DSH Hospitals

All States Will See Net Increase in Total OPPS Payments Across Hospitals Not Impacted by 340B Drug Payment Cuts

HOSPITALS NOT IMPACTED BY 340B PAYMENT CUTS WILL BENEFIT FROM OPPS REDISTRIBUTION EFFECTS

THE AVERAGE STATE-LEVEL NET INCREASE IN TOTAL OPPS PAYMENTS AMONG THOSE HOSPITALS WILL BE 4.3%

Appendix

Methodology

PART B DRUG SPENDING: Avalere analyzed 2016 Part B drug spending using the Medicare Standard Analytical File (SAF) that includes 100% of fee-for-service (FFS) drug billing by hospital outpatient departments (HOPDs)

PART B DRUG SELECTION: Avalere identified Part B drugs reimbursed by Medicare based on ASP methodology

- J-, Q-, A- and P-codes: Avalere captured all drugs appearing in the quarterly 2016 ASP Drug Pricing Files¹

- Vaccines/Numerical codes: Avalere excluded vaccines per OPPS rule

HOSPITAL SELECTION: Our analysis included 3814 hospitals paid under OPPS, not including 53 children’s and 11 free-standing cancer “held harmless” hospitals that receive proportional adjustments to their OPPS payment rates and are excluded from CMS’ impact file.² Those hospitals are not subject to the part B drug payment reduction even though they are 340B-eligible. Similarly, Critical Access Hospitals and hospitals located in Maryland are eligible for 340B prices but not paid under OPPS methodology.

TOTAL OPPS PAYMENT IMPACT: Avalere analyzed CMS-estimated hospital-level OPPS payments for CY2017 and CY2018 to determine the overall impact of the rule that captures both, 340B drug payment reduction and all other annual payment updates²; CMS’s payment estimates reflect only rate updates and do not include changes in service volume, service-mix, or number of encounters, all of which would affect the actual payments to hospitals.

340B PARTICIPATION: Avalere assessed current (as of January 2018) hospital 340B participation using the 340B Office of Pharmacy Affairs information System (340B OPAIS) from Health Resources and Services Administration (HRSA)

- Source: Centers for Medicare & Medicaid Services. “Calendar Year 2018 Outpatient Prospective Payment System and Ambulatory Surgical Center final rule,” November 2017

ASP: Average Sales Price; CMS: Centers for Medicare & Medicaid Services

*The budget sequestration of 2013 reduced the Part B add-on payment from ASP + 6% to ASP + 4.3%

**The budget sequestration of 2013 would further reduce the proposed Part B payment rate from ASP –

22.5% to ASP – 23.7% 4

Source: Centers for Medicare & Medicaid Services. “Calendar Year 2018 Outpatient Prospective

Example is illustrative only. The ASP payment is split to reflect the beneficiary paying 20% and Medicare paying 80% of drug costs. Medicare payments are adjusted to represent a 2% reduction due to the

sequester (currently ASP + 4.3% and proposed ASP – 23.7%). Beneficiary coinsurance is not impacted by

the sequester. The amounts shown only reflect payments for a specific drug, and does not account for

Note: See Appendix for full description of methodology

*The budget sequestration of 2013 reduced the Part B add-on payment to 4.3%; the sequester would further reduce the proposed OPPS B payment rate from -22.5% to -23.7%

Majority or 92% of hospitals not impacted by the 340B drug reimbursement cut are non-340B; the remaining 8% represent rural sole community hospitals that are 340B program participants but were purposely excluded from thee 340B payment cut.

DSH hospitals represent 93% of all 340B hospitals impacted by OPPS 340B drug payment cuts. Other affected hospitals include rural referral centers and non-rural sole community hospitals.